https://www.nextbigfuture.com/2018/04/v ... ction.htmlVanadium for batteries can be extracted from Canada’s oilsands and potentially double world production

brian wang | April 21, 2018

Vanadium is a largely obscure metal often used in making steel. It retains its hardness at high temperatures, so it’s ideal for making drill bits, engine turbines and other parts that generate heat.

In the oilsands, Vanadium is one of the metals that comes out of the ground with bitumen. The concentration is quite low: a barrel of bitumen would contain just 30 milliliters of vanadium, on average, experts says. But multiplied by the millions of barrels of production from the oilsands every day would be about 33,000 liters of vanadium. Vanadium has a density of 3.36 grams per cc. So a million barrels of oil would be about 100,000 kilograms (100 tons). One year of production would be about 36500 tonnes.

Canada’s oilsand produced 2.4 million barrels per day in 2016.

Global production of vanadium totaled 79,400 tonnes in 2015. Although the vanadium market has struggled in recent years, it’s expected that global demand for vanadium will more than double by 2025, according to Merchant Research & Consulting.

Oilsand Vanadium could more than double current world production.

Shell’s project aims to extract a metal called vanadium from bitumen and use the material to produce large, utility-scale electricity storage for the renewable energy sector, which has struggled with ways to store large amounts of energy in a stable, reliable way.

Vanadium

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Minerais : réserves ,recyclage, et déplétion.

Du Vanadium pourrait étre retiré en sous produit des sables bitumineux du Canada.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Vanadium

https://www.agenceecofin.com/metaux/230 ... inexploiteMozambique : le projet Caula contient plus de 81 600 tonnes de vanadium inexploité

Agence Ecofin 23 juillet 2018

Alors que le marché mondial du vanadium est au beau fixe, Mustang Resources a publié ce week-end une déclaration de ressource vierge (inexploitée) pour sa mine Caula, au Mozambique.

Selon l’évaluation, le projet hébergerait 22 millions de tonnes de ressources «mesurées» titrant 0,37% de pentoxyde de vanadium (V2O5). En d’autres termes, la mine de graphite-vanadium contient pas moins de 81 600 tonnes de vanadium, soit environ 180 millions de livres.

Pour le DG de la compagnie, Dr Bernard Olivier, la combinaison des ressources de vanadium et de graphite montre que «Caula émerge rapidement comme un projet de grande valeur».

Le marché du vanadium est au beau fixe

Cette déclaration de ressource inexploitée intervient à une bonne période pour la société qui envisage de devenir un des leaders de la production de graphite et de vanadium. En effet, la tonne de pentoxyde de vanadium se négocie actuellement à plus de 40 000 $ et la demande chinoise est en hausse. Selon le Mining Journal du 28 juin 2018, la demande dans l’Empire du Milieu a augmenté de 15% d’avril à mai, «car les aciéries sont prêtes à passer à la production d’acier plus résistant».

Il faut également noter que le volume de vanadium utilisé dans les batteries était de 3 000 tonnes en 2017, soit le double de 2016. Commentant l’état du marché et notamment le prix du vanadium, M. Olivier a fait remarquer le «grand» potentiel économique de la ressource de Caula.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Minerais : réserves ,recyclage, et déplétion.

Long article sur le Vanadium qui devrait dans quelques années supplanter le Lithium pour les batteries stationnaires géantes.

https://oilprice.com/Energy/Energy-Gene ... Metal.htmlMove Aside Lithium – Vanadium Is The New Super-Metal

By James Burgess - Oct 10, 2018,

The lithium ride was a great one. Cobalt, too. All they needed was their Elon Musk moment, which came in the form of the Nevada battery gigafactory. The next Elon Musk moment won’t be about lithium at all—or even cobalt. It will be for an element that takes everything electric to its revolutionary finish line: Vanadium.

The one moment that will change everything … and that moment may be near.

Vanadium is lithium on steroids—wildly bigger and the only way forward from here. We may have already reached the peak of our electric revolution through batteries with lithium.

We need bigger batteries, preferably the size of a football field—or 20.

That’s vanadium—Element 23. The answer to our issue of scale.

“It’s no longer a technological maybe,” says Matt Rhoades, president and CEO of United Battery Metals, a Colorado vanadium explorer sitting on one of the few known sources of the next big battery metal in the entire United States.

Rhoades should know … his company is behind the discovery that hopes to put America definitively on the vanadium map. UBM’s Wray Mesa Project in Colorado has a mineral resource base estimate indicating resource of around 2.7 million pounds of vanadium—not to mention all the uranium they already know is there for additional upside.

“Vanadium is here, and lithium is scared because the $13-billion energy storage market has already found its new poster boy,” Rhoades told Oilprice.com.

The Moment of Truth

Indeed, Rhoades is an expert at timing.

The worldwide battle for vanadium is ramping up …

The Chinese have already had their Elon Musk moment …

The U.S. has none …

And vanadium was the best-performing battery metal last year, beating out even lithium and cobalt.

The truth is that it’s been a long road for vanadium to not only break into the energy storage market, but to actually become the future of the energy storage market.

The next ‘moment’ will be when someone in the U.S.—always one step behind the Chinese—announces plans for an American vanadium battery gigafactory. Anyone who hasn’t gotten in before that moment will be nursing their lithium hangover.

China is already building the world’s largest vanadium flow battery (VFB) gigafactory in Dalian, with the massively powerful (200MW/800MWh) batteries to be manufactured by Rongke Power.

.......

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Un gisement d' Uranium et Vanadium en Argentine.

https://investorintel.com/investorintel ... um-corp-2/2018 Blue Sky Uranium’s CEO on their 10 million pounds of vanadium

“We have a substantial amount of vanadium in our deposit. In the Ivana deposit that we recently announced 20 million pounds of uranium there is 10 million pounds of vanadium. While in the past, just a few years ago, that was considered a nice byproduct, now it is a significant product because we have seen the price of vanadium move from $4.00 a pound to currently $19.30 a pound. It is adding a substantial amount of economic value to every scoop of ore, every pound of ore that we take out of ground. We are seeing vanadium moving forward as a battery metal. The price is going up. We have a very large property package. Some parts of it have a 1 to 1 with uranium. Some parts of it are primarily vanadium.” States Nikolaos Cacos, President, CEO and Director of Blue Sky Uranium Corp. (TSXV: BSK | OTCQB: BKUCF), in an interview with InvestorIntel Corp. CEO Tracy Weslosky.

https://www.ftmig.com/resources/blue-sk ... argentina/About the Amarillo Grande Project

The Company's 100% owned Amarillo Grande Uranium-Vanadium Project in Rio Negro Province, Argentina is a new uranium district controlled by Blue Sky. The Project includes several major target areas over a regional trend, with uranium and vanadium mineralization in loosely consolidated sandstones and conglomerates, at or near surface. The area is flat-lying, semi-arid and accessible year-round, with nearby rail, power and port access. The Company’s strategy includes delineating resources at multiple areas for which a central processing facility could consolidate production. The Ivana deposit is the cornerstone of the Project and the first area to have a NI 43-101 Inferred Resource estimate, which includes 23.9 million tonnes averaging 0.036% U308 and 0.019% V2O5, containing 19.1 million pounds of U3O8 and 10.2 million pounds of V2O5, at a 100 ppm uranium cut-off.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Du Vanadium en Australie

https://www.australianmining.com.au/new ... roduction/Australian Vanadium reveals Gabanintha production potential

September 26, 2018

Australian Vanadium’s pre-feasibility study (PFS) shows the Gabanintha project to be a robust base case, with a planned production rate of around 10,100 tonnes of vanadium pentoxide (V2O5) per year.

The project boasts an initial mine life of 17 years, with potential to extend operations by an additional 8km along strike.

The PFS estimated average operating expenses of around $US4.13 ($5.69) per pound of V2O5 equivalent. This is considered by Australian Vanadium as competitive with the world’s lowest quartile producers.

Company managing director Vincent Algar said, “Our intention with the ongoing feasibility study work is to understand and design a long-life, low-cost vanadium pentoxide and cobalt concentrate production facility.

“It is essential that all technical aspects are understood, and the capital and operating costs minimised, given the cyclical nature of the vanadium markets.”

The project’s capital costs are estimated to be around $US360 million ($496 million).

The Gabanintha operation is comprised of a proposed open pit mine; crushing, milling and beneficiation plant (CMB); and refining plant for final conversation and sale of V2O5. This will be used toward development of energy storage markets and production of steel and specialty alloys.

The PFS is on track for completion in December, which will allow Australian Vanadium to proceed into piloting and definitive feasibility study (DFS).

Earlier this month, Australian Vanadium was granted a licence for a new tenement south of the Gabanintha vanadium resource near the mining town of Meekatharra in Western Australia.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

https://investingnews.com/daily/resourc ... countries/4 Top Vanadium-producing Countries

Amanda Kay - May 28th, 2018

The vanadium market has been fairly quiet in recent years, but in 2017 the market picked up, with prices reaching a four-year high in May of that year.

The silvery-grey metal is mainly used to make ferrovanadium, an alloy of iron and vanadium that is used in the production of steel and other alloys. China is the leading producer of ferrovanadium, but many Chinese manufacturers have been shut down recently due to increased environmental requirements.

These shutdowns helped spark last year’s price increase, although interest in vanadium redox batteries also helped the industry receive some buzz.

On the supply side, world vanadium production totaled 80,000 MT last year, up slightly from 79,000 MT in 2016, as per the most recent data from the US Geological Survey. Only four countries contributed to that output, and below is a brief overview of all of those producers.

1. China

Mine production: 43,000 MT

China was the world’s top vanadium producer in 2017 with output of 43,000 MT. That’s down from the 45,000 MT it put out the previous year.

The Asian nation far outpaces all other countries in terms of vanadium production, and is also a large consumer of the metal. As mentioned, the metal is largely used in the production of steel. Although Chinese steel output has declined in recent years, the country remains a major vanadium consumer.

2. Russia

Mine production: 16,000 MT

Second on the list is Russia, whose vanadium production totaled 16,000 MT in 2017, the same as its 2016 output. Russia’s vanadium reserves are the second largest in the world at 5,000 MT. Little other information is available about vanadium mining in Russia.

3. South Africa

Mine production: 13,000 MT

Vanadium output in South Africa has been on a upward trend in recent years. In 2017, the country put out 13,000 MT of the metal, up from 10,000 MT in 2016. The country’s Evraz Highveld vanadium and iron mine shut down in 2015, but vanadium mining production has since recovered.

Bushveld Minerals’ (LSE:BMN) vanadium division is comprised of three assets in South Africa’s Bushveld Complex. The company says that together they have a JORC resource base of 439.6 million tonnes, including 55 million tonnes of JORC reserves, with “some of the highest primary grades in the world.”

4. Brazil

Mine production: 8,400 MT

Last is Brazil, whose vanadium production ramped up to 8,400 MT in 2017 from 8,000 MT in 2016.

Brazil’s production increase is largely thanks to Largo Resources (TSX:LGO), which describes itself as the only pure-play vanadium producer. The company’s Maracas Menchen mine is the highest-grade vanadium mine in the world, and achieved record quarterly production in Q4 2017, reaching 2,539 tonnes of vanadium pentoxide. Its guidance for 2018 is 8,950 to 9,950 tonnes of vanadium pentoxide.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

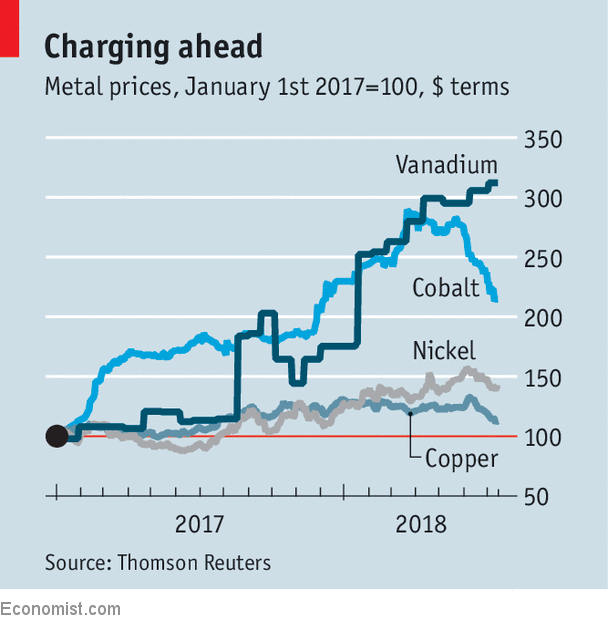

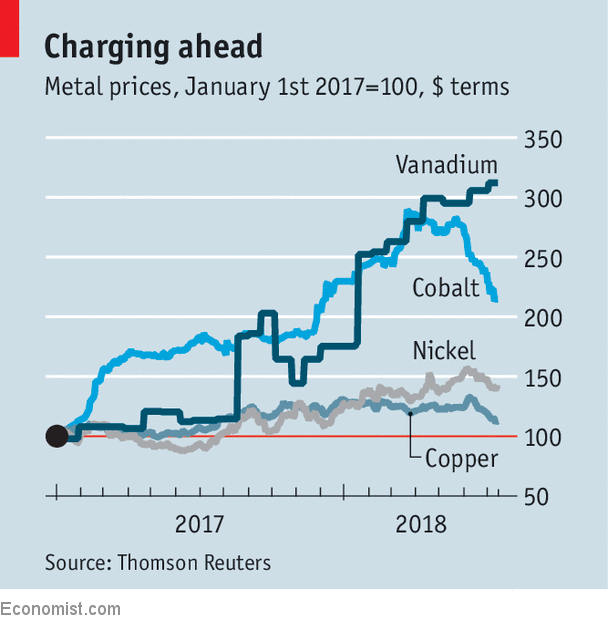

Évolution du cours du cuivre, nickel, Cobalt et vanadium.

Base 100 le 1er janvier 2017

Base 100 le 1er janvier 2017

- Remundo

- Hydrogène

- Messages : 9604

- Inscription : 16 févr. 2008, 19:26

- Localisation : Clermont Ferrand

- Contact :

Re: Vanadium

ah oui ils parlent du Vanadium pour les "redox flow batteries",

on avait évoqué ça avec les voitures Quant. viewtopic.php?f=15&t=29362

on avait évoqué ça avec les voitures Quant. viewtopic.php?f=15&t=29362

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Encore un article sur le hype au sujet du Vanadium.

https://oilprice.com/Energy/Energy-Gene ... Niche.html

On y apprend un gisement de Vanadium combiné à de l' Uranium aux USA, dans le Colorado.

https://oilprice.com/Energy/Energy-Gene ... Niche.html

On y apprend un gisement de Vanadium combiné à de l' Uranium aux USA, dans le Colorado.

United Battery Metals Corp (CSE:UBM, OTC:UBMCF) has the Wray Mesa Project - an exploration stage uranium-vanadium property located in Montrose County, Colorado.

Their property sits in the vanadium rich sandstone of the Colorado Plateau.

It consists of over 39 contiguous mining claims for a total size of about 800 acres. It could be the one of the first vanadium mines in the United States.

Drill exploration started in the late 1940’s with the U.S. Geological Survey, then continued from the 1960’s through the 1980’s with the private sector.

For nearly a decade, the property hosted a producing uranium mine.

Over 739 historical drill holes have been punched across all 39 claims - at a cost that would exceed $30 million today. UBMCF inherited this exploration windfall.

The company now has an NI-43-101 on the property authored by Antony Adkins in 2013. According to that report, they’re sitting on an estimated 2.7 million pounds of vanadium and an indicated resource of 500,000 pound of uranium.

This confirmed resource dramatically lowers their risk.

.........

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Expansion du Vanadium au Bresil :

http://www.mining.com/largo-allowed-exp ... ne-brazil/Largo to expand vanadium mine in Brazil

Mining. Com Nov 2, 2018

Brazil's Institute of Environment and Water Resources (IBAMA) has issued an environmental license for the Maracás Menchen Mine expansion project, owned by Largo Resources (TSX: LGO).

Maracás Menchen is a 17,690-hectare property located in the eastern Bahia State of Brazil, roughly 250 kilometres southwest of the state capital, Salvador. According to Largo, the mine boasts one of the highest-grade vanadium resources in the world and is one of the lowest cost producers of the material in the vanadium market.

Commercially active since 2014, the operation has a take-or-pay off-take agreement with Glencore (LON: GLEN) for 100% of its vanadium material and it is expected to produce between 8,950 and 9,950 tonnes of vanadium pentoxide in 2018.

With the recently approved expansion, Largo wants to grow output by 25% by increasing the production capacity of the milling, fusion (deammoniator, furnace and flaking wheel), leaching and filtering areas. This would result in an additional 200 tonnes of V2O5 being produced per month, totaling 1,000 tpm after June 2019.

The Toronto-based miner is investing $15.5 million in the expansion, which began back in June, and is aiming for completion within 12 months.

"Securing this permit was a key milestone in our expansion project and we now look forward to delivering a substantial increase in capacity on time and on budget. Demand for vanadium continues to increase worldwide and the supply side fundamentals continue to indicate a shortage of the commodity in the near-term. Largo continues to believe an elevated price environment for vanadium will persist,” Mark Smith, Chief Executive Officer for Largo, said in a media statement.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Du Vanadium aux États Unis., en Utah.

https://investorintel.com/sectors/urani ... -producer/Energy Fuels set to become the world’s newest vanadium producer.

MATTHEW BOHLSEN | DECEMBER 03, 2018

Vanadium metal prices have been hotter than hell in 2018 leading many companies to assess their vanadium options. With current demand in China for vanadium through new laws that require the steel hardening metal in rebar, prices for vanadium have gone through the roof. Currently prices are at US$30.90 for China spot vanadium and US$28.75/lb for European spot vanadium.

Energy Fuels Inc. (NYSE American: UUUU | TSX: EFR) communicated to the market that they are starting vanadium production from their 100% owned La Sal Complex of uranium/vanadium mines in Utah, with plans to be very aggressive in the market. Energy Fuels state they are the only company in the United States that can produce vanadium from primary ore sources. They believe this will provide an opportunity for investors to get exposure in the vanadium market as well as the uranium market.

The Company believes it may also be able to recover up to 4 million pounds of solubilised vanadium from their White Mesa Mill tailings pond. In total Energy Fuels in ground vanadium resource is 32M lbs.Energy Fuels to become the newest vanadium producer in the worldMark S. Chalmers, Energy Fuels’ President and CEO, stated: “During the past quarter Energy Fuels continued to pursue a number of major opportunities that we believe will continue to build shareholder value. I’m currently most excited about Energy Fuels becoming the newest vanadium producer in the World.

”The plan is to ramp production to 200,000 – 225,000 pounds of V2O5 per month from the White Mesa Mill, for a period of up to 20 months, subject to conditions, costs, and recoveries.

This production should coincide very well with today’s strong vanadium prices that have risen about 3 fold in 2018. Energy Fuels are looking forward to taking their place as the only primary producer of V2O5 in North America.

..........

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

American Battery Metals va faire 10 forages pour rechercher du Vanadium en Utah.

C'est mêlé avec de l'uranium.

C'est mêlé avec de l'uranium.

http://www.mining.com/american-battery- ... m-project/American Battery Metals ready to drill at Utah vanadium project

American Battery Metals (CSE: ABC) announced that later this month it will start an exploration program at its Temple Mountain vanadium property in Emery County, Utah.

With $1.5 million in funding, the campaign will be comprised of radon geophysical surveying, trenching and sampling, and reverse circulation drilling of 10 holes for 3,000 feet.

According to American Battery Metals, the geophysical survey will utilize a proprietary radon cup methodology to identify vanadium and uranium-bearing channels. The method has reportedly been successful in delineating mineralized zones in other projects throughout southeast Utah.

"The exploration we will be undertaking over the next few months should provide us with a clear way forward in increasing the value of the Temple Mountain property and, to a large degree, de-risk our future exploration program," Michael Mulberry, President & CEO of the Canada-based company, said in a press release.

Corporate information states that the 2019 program will follow-up on historical assays, which ranged as high as 4.97% vanadium oxide. On-site experts will also explore numerous historical mine workings.

Temple Mountain has seen intermittent production dating back to 1914. Later on, in the 1940s, 3.8 million pounds of vanadium oxide (V2O5) and 1.3 million pounds of uranium (U3O8) were shipped from this deposit as part of the Manhattan project.

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Du Vanadium au Canada, le projet four corner.

Évaluation du gisement à réaliser.

Évaluation du gisement à réaliser.

http://www.mining.com/delrey-acquire-va ... foundland/Delrey to acquire vanadium property in Newfoundland

MINING.com Staff 22 Marc 2019

.....

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Du Vanadium au Nevada.

Évaluation du gisement à réaliser.

Évaluation du gisement à réaliser.

http://www.mining.com/first-vanadium-do ... ty-nevada/First Vanadium more than doubles size of Carlin property

MINING.com Editor 20 March 2019

........

The Carlin vanadium project contains one of North America’s largest, richest primary vanadium deposits.

.......

- energy_isere

- Modérateur

- Messages : 103476

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Vanadium

Suite du post précédent.Le gisement du Nevada serait le plus gros d'Amérique du Nord.

http://www.mining.com/first-vanadium-sa ... ectations/First Vanadium says Nevada project resource estimate exceeds expectations

10 April 2019

The Carlin property is located in North-Central Nevada in Elko County. (Image courtesy of First Vanadium.)

Canada’s First Vanadium has published indicated mineral resources for its Nevada-based Carlin project, considered the largest, highest grade primary vanadium deposit in North America.

The company, which in March more than doubled the size of the vanadium property from 1,331 acres to 3,177 acres, said Carlin’s maiden resource has far exceeded expectations and will provide a base for an economic study.

Based on the 43-101 technical report filed by Fist Vanadium, Carlin's indicated resource stands at 24.64 million tonnes at 0.615% V2O5 for 303 million pounds, and inferred at 7.19Mt at 0.52% V2O5 for 75Mlb.

Both the inferred and indicated categories used a 0.3% cut-off grade and the results replace an historic 2010 resource estimate.

First Vanadium has the option to earn 100% of the project, which now exceeds the numbers quoted in a 2017 USGS paper.

The news comes at a time of high prices for silvery-grey metal, used to harden steel and in the making of flow batteries, which are long-lasting, durable and can hold large amounts of energy.

More than 90% of the world's vanadium is currently used in steel manufacturing applications, but the metal’s importance to the energy sector is also growing rapidly, with more than 5% of global output used in energy storage.

Vanadium prices more than doubled in 2018, reaching historic peaks. Fastmarkets’ price assessment of ferro-vanadium, basis 78% min, free delivered duty-paid to consumer works in Europe stood at $126-128 per kg on November 23, 2018, the highest it has ever been.