L' argent (silver)

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

L' argent (silver)

Silver - The Element of Change vidéo 7mn https://www.youtube.com/watch?v=jRwUmGpmF38

Silver Institute

1,02 k abonnés

137 975 vues 4 févr. 2013

The Silver Institute released a new video entitled, "Silver: The Element of Change." The video covers numerous facets of one of the most widely-used and indispensable precious metals: silver. The video explores silver's role in history and how it changed the course of countless lives in times of the Greek and Roman Empires, when it was used to prevent infection.

Focusing on its remarkable properties as an element of change, the video looks at silver's role in industry, highlighting its ability to make today's mobile interconnected life possible as well as its use in medicine and water purification, which relies primarily on its natural antibacterial qualities. The video also notes silver's importance to fashion through exquisite silver jewelry, and finally it speaks to silver's intrinsic worth as well as its role as a store of value, given its historical and modern use as a popular investment.

Silver Institute

1,02 k abonnés

137 975 vues 4 févr. 2013

The Silver Institute released a new video entitled, "Silver: The Element of Change." The video covers numerous facets of one of the most widely-used and indispensable precious metals: silver. The video explores silver's role in history and how it changed the course of countless lives in times of the Greek and Roman Empires, when it was used to prevent infection.

Focusing on its remarkable properties as an element of change, the video looks at silver's role in industry, highlighting its ability to make today's mobile interconnected life possible as well as its use in medicine and water purification, which relies primarily on its natural antibacterial qualities. The video also notes silver's importance to fashion through exquisite silver jewelry, and finally it speaks to silver's intrinsic worth as well as its role as a store of value, given its historical and modern use as a popular investment.

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

Reportage dans une mine d' Argent de Endeavour. Il s'agit d'une mine d'Argent de taille modeste, ca semble être aux USA.

How Silver is Mined (2 of 2) vidéo 6mn https://www.youtube.com/watch?v=yGGUgC7V-vs

Endeavour Silver Corp

3,01 k abonnés

90 015 vues 22 mars 2011

Ever wonder how silver mining actually works ?

Life inside a mine, the process of drilling and extraction, separation processes and the pouring of silver bars are covered in this second part of a two part documentary on the science of silver mining.

How Silver is Mined (2 of 2) vidéo 6mn https://www.youtube.com/watch?v=yGGUgC7V-vs

Endeavour Silver Corp

3,01 k abonnés

90 015 vues 22 mars 2011

Ever wonder how silver mining actually works ?

Life inside a mine, the process of drilling and extraction, separation processes and the pouring of silver bars are covered in this second part of a two part documentary on the science of silver mining.

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

https://www.mining.com/lower-silver-out ... roduction/Lower silver output in Peru, Mexico to drag down global production

Staff Writer | November 17, 2023

Global mined silver production will fall 2% in 2023 to 820 million ounces from 2022 totals due to lower output from operations in top producing countries Mexico and Peru, The Silver Institute said.

“Production from Mexico is expected to fall by 16 million ounces due to the impact of the suspension of operations at Newmont’s Peñasquito in the second and third quarter in response to a labour strike,” the industry body said.

“Even so, overall production from primary silver mines will still rise this year, driven by the expected ramp-up at MAG Silver’s Juanicipio mine,” it added.

Silver is used in many industries including electronics and solar panels, and demand is expanding as the world moves away from fossil fuels.

Newmont (NYSE: NEM) (TSX: NGT), the world’s largest gold producer, began resuming operations at its Peñaquito mine in Mexico in October.

The asset, which is also Mexico’s largest gold mine, was halted for four months, costing the company millions of dollars a day.

The effects of this disruption were partially offset by the opening of Fresnillo’s (LON: FRES) and MAG Silver’s (TSX: MAG) Juanicipio mine in the Mexican state of Zacatecas.

The report, co-prepared by precious metals research consultancy Metal Focus, still predicts that 2023 will see another sizable physical silver shortfall, which would make it the third consecutive year of an annual deficit.

“At 140 million ounces, this will be 45% lower than 2022’s all-time high, but this is still elevated by historical standards,” the authors said.

The Silver Institute also highlighted that Metals Focus believes the deficit will persist for the foreseeable future.

“Metals Focus expects the average silver price to increase by 6% year-on-year to $23.10 [per ounce] this year.”

The largest silver producing nations last year were Mexico, China, Peru, Poland and Russia. Fresnillo, KGHM, Newmont, Glencore and Hindustan Zinc took the top spots in the ranking of largest silver producing companies.

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

https://www.northernminer.com/news/ande ... 003862301/Andean Precious Metals adds eight years to Bolivia silver mine life

DECEMBER 27, 2023

A new reserve estimate for the San Bartolomé silver mine in Bolivia underpins an eight-year extension to the mine plan through 2028, Andean Precious Metals (TSXV: APM; US-OTC: ANPMF) said Wednesday.

The update extends the mine’s life well into 2028, far beyond its original 12-year expectancy that was supposed to end in 2020.

.....................

Prepared by SRK Consulting, the 2023 mineral reserve and resource estimate now shows measured and indicated resources of 6.1 million tonnes grading 98 grams silver per tonne for 19 million oz. and a recoverable proven and probable reserve of 5.08 million tonnes at 93 grams silver per tonne for 11.95 million oz. metal (as opposed to contained metal of 15.19 million ounces).

.........................

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

suite de ce post du 12 dec 2021 : http://www.oleocene.org/phpBB3/viewtopi ... 3#p2332643

Forte augmentation des ressources découvertes au Panuco silver-gold project au Mexique

sur le site du minier : https://vizslasilvercorp.com/projects/p ... t-details/

Forte augmentation des ressources découvertes au Panuco silver-gold project au Mexique

https://finance.yahoo.com/news/vizsla-s ... 00688.htmlVizsla Silver Corp. is pleased to announce an updated mineral resource estimate ("Updated Mineral Resource Estimate") for its flagship, 100% owned Panuco silver-gold project (the "Project" or "Panuco") located in Sinaloa, Mexico. The Updated Mineral Resource Estimate was completed by Allan Armitage, Ph.D., P.Geo., of SGS Geological Services.

January 8, 2024

Highlights of the Updated Mineral Resource Estimate, including a comparison to the previous mineral resource estimate released in January 2023:

48.7% increase in indicated mineral resources from 104.8 to 155.8 Moz AgEq

48.7% increase in inferred mineral resources from 114.1 to 169.6 Moz AgEq

17% increase in average indicated mineral resource grade from 437 to 511 g/t AgEq

................................

sur le site du minier : https://vizslasilvercorp.com/projects/p ... t-details/

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

Un prospect d'Argent au Mexique : Cigarra

https://www.mining.com/kootenay-silver- ... ved-grade/Kootenay Silver updates La Cigarra resource, showing improved grade

Staff Writer | January 25, 2024

Mexico-focused Kootenay Silver (TSXV: KTN) has released an updated NI 43-101 mineral resource estimate (MRE) for its 100% owned La Cigarra project located in the Parral silver district of Chihuahua state. The MRE showed an improvement in silver grade compared to the previous one from 2015.

Measured and indicated resources are estimated at 15.7 million tonnes grading 102 g/t silver, 0.07 g/t gold, 0.16% lead and 0.21% zinc, for 120 g/t silver equivalent (AgEq). The contained metal is 51.6 million oz. of silver, 33,900 oz. of gold, 54.8 million lb. of lead and 73.5 million lb. of zinc for 60.6 million oz. of AgEq.

SIGN UP FOR THE PRECIOUS METALS DIGEST

Inferred resources are estimated at 3.4 million tonnes grading 102 g/t silver, 0.06 g/t gold, 0.20% lead and 0.19% zinc (119 g/t AgEq), containing 11 million oz. of silver, 6,000 oz. of gold, 14.8 million lb. of lead and 13.8 million lb. of zinc (12.9 million oz. AgEq).

The 102 g/t silver grade (in all categories) represents a near 20% increase in the M+I grade calculated in 2015, and a 25% increase in the inferred grade.

The updated resource estimate for La Cigarra, according to Kootenay’s CEO James McDonald, is part of the company’s strategy to prepare its three resource projects — La Cigarra, Promontorio and La Negra — for advancement in a bullish silver market, while also moving the high-grade Columba towards an MRE.

.....................

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

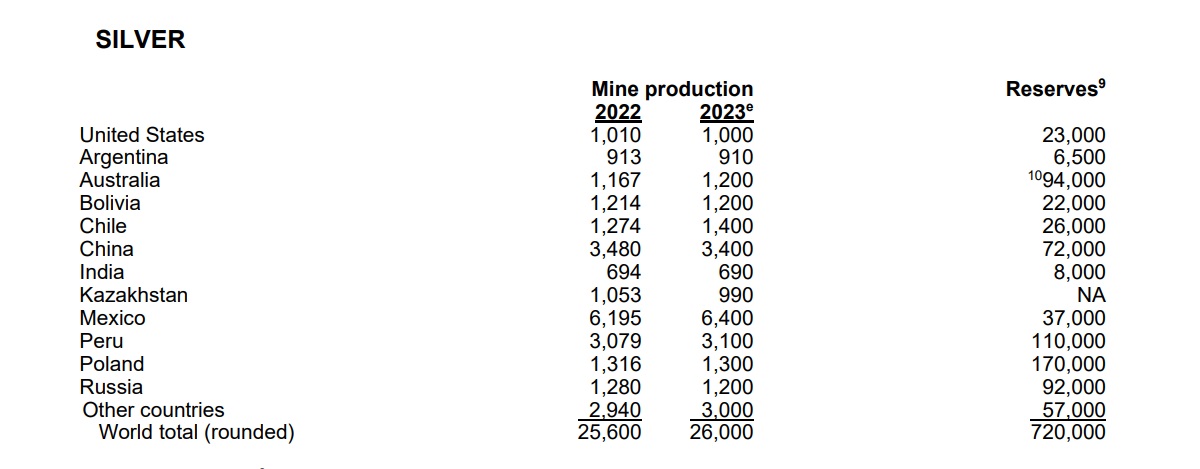

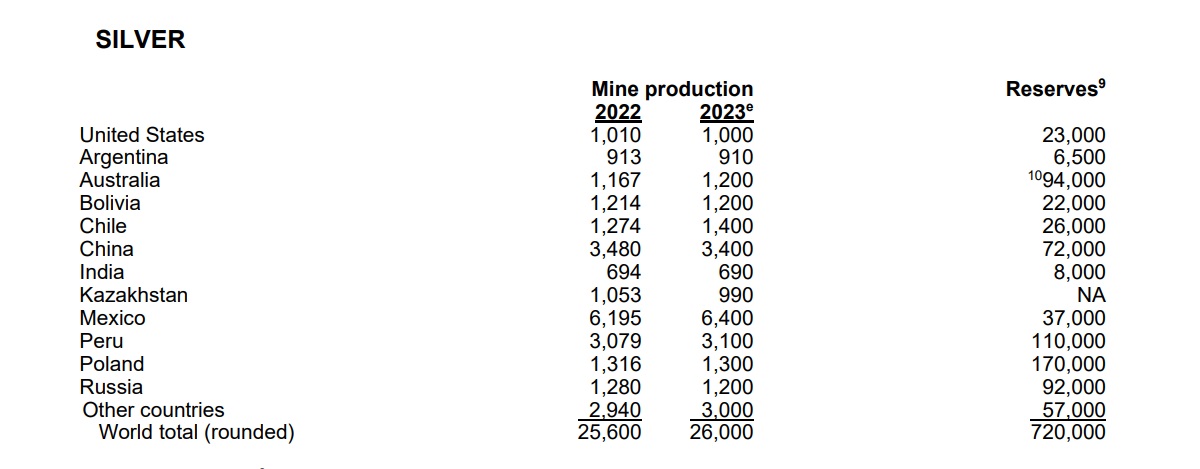

la derniére fiche usgs pour l' argent : https://pubs.usgs.gov/periodicals/mcs20 ... silver.pdf

+1.5% sur la production mondiale.

La Pologne et la Russie augmentent leur reserves par rapport à l' an dernier.

Data in metric tons

ce que j' avais posté l'an dernier : http://www.oleocene.org/phpBB3/viewtopi ... 6#p2362816

+1.5% sur la production mondiale.

La Pologne et la Russie augmentent leur reserves par rapport à l' an dernier.

Data in metric tons

ce que j' avais posté l'an dernier : http://www.oleocene.org/phpBB3/viewtopi ... 6#p2362816

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

suite de ce post du 24 sept 2023 http://www.oleocene.org/phpBB3/viewtopi ... 8#p2377198

https://www.mining.com/web/adriatic-met ... lver-mine/Adriatic Metals produces first concentrate at Bosnian silver mine

Reuters | February 28, 2024

Vares silver project. (Image courtesy of Adriatic Metals.)

British-based Adriatic Metals has produced the first concentrate at its Vares silver project in central Bosnia, the company said on Wednesday.

Adriatic Metals, which had planned to start production at the Vares mine in January, produced the first concentrate on Tuesday but the plant’s official opening will be in March after six years of exploration and a $200 million investment.

The project will continue to ramp up processing capacity to about 65,000 metric tons a month by the fourth quarter of this year, the company said.

Production will be increased by blending high-grade stockpiled ore with lower grade stockpiles, it added.

Adriatic Metals expects to dig about 800,000 tons of polymetallic ore per year from the mine, producing about 65,000 tons of lead-silver concentrate and 90,000 tons of zinc concentrate, with annual ore export revenue of about 800 million Bosnian marka ($444 million).

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

Fermeture définitive de la mine d'Argent et Or San Jose

https://www.mining.com/fortuna-silver-t ... e-closure/Fortuna Silver takes $90.6m charge on Mexican mine closure

Cecilia Jamasmie | March 7, 2024

The San Jose silver and gold mine began commercial production in 2011. (Image courtesy of Fortuna Silver.)

After more than a decade in operations, Fortuna Silver (TSX: FVI) (NYSE: FSM) will cease activities at its San José mine in Mexico this year, six months earlier than planned, due to rising costs and depleted reserves.

The Canadian miner, which reported a loss of $92.3 million in the fourth quarter of 2023, booked a $90.6 million charge related to the anticipated closure of the operation, which would leave about 5,800 direct and indirect employees in limbo.

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

Une nouvelle mine d'Argent va ouvrir au Pérou :

https://www.mining.com/web/peru-approve ... nvestment/Peru approves Buenaventura silver mine with $144 million investment

Reuters | March 20, 2024 |

Peru’s government on Wednesday said it had authorized Buenaventura, one of the Andean nation’s largest precious metals producers, to exploit a new silver mine with an investment of at least $114 million.

The Yumpag silver project was approved to mine 1,000 metric tons per day, which will allow it to produce an estimated 6.5 to 7.2 million ounces of silver (184 to 204 tons) by 2024, the country’s energy and mines ministry said in a statement.

Buenaventura said it would start a first phase of explorations “in the short-term” funded with $84 million while at least $30 million would contribute to a second phase.

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

https://www.agenceecofin.com/metaux/170 ... -boumadineMaroc : le canadien Aya estime à 72 millions d’onces l’argent contenu dans les ressources minérales du projet Boumadine

Agence Ecofin 17 avril 2024

Aya Gold & Silver a annoncé une production d’argent de 1,97 million d’onces en 2023, et prévoit de produire 2,6 à 3,2 millions d’onces en 2024. Outre sa mine Zgounder actuellement en exploitation, la compagnie canadienne peut en développer une deuxième à Boumadine.

Le canadien Aya Gold & Silver a publié le 16 avril une estimation de ressources minérales pour son projet polymétallique Boumadine. Il hébergerait 72 millions d’onces d’argent et 2,1 millions d’onces d’or dans les ressources minérales, dont 64,7 millions d’onces d’argent et 1,98 million d’onces d’or dans les ressources inférées.

Cette mise à jour est le fruit des travaux de forages menés entre 2018 et 2023, incluant 96 301 mètres de forages au diamant. Ces travaux se poursuivront en 2024 avec un programme de 120 000 mètres. L’objectif est d’accroitre l’estimation de ressources à partir des cibles déjà connues tout en identifiant de nouvelles zones minéralisées.

« Le forage s’est concentré uniquement sur le permis d’exploitation minière, une petite partie de l’empreinte minéralisée globale. Nous continuerons à consolider la zone et à forer agressivement les extensions de la tendance principale en vue d’augmenter les ressources minérales », a commenté Benoit La Salle, PDG de la compagnie.

Pour rappel, le Maroc est le premier producteur africain d’argent et Aya Gold & Silver est l’un des leaders de la production marocaine avec sa mine Zgounder. La compagnie peut accroitre son influence dans le secteur en développant une nouvelle mine à Boumadine.

- energy_isere

- Modérateur

- Messages : 90157

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: L' argent (silver)

https://www.pv-magazine.com/2024/04/19/ ... this-year/PV industry demand for silver could rise by 20% this year

Demand for silver in the photovoltaic industry hit 193.5 million ounces in 2023, according to the Silver Institute. It predicts that demand will grow by another 20% in 2024.

APRIL 19, 2024 PATRICK JOWETT

Demand for silver in the PV industry increased by 64% from 118.1 million ounces (Moz) in 2022 to 193.5 Moz in 2023, according to the World Silver Survey 2024, which was recently published by the Silver Institute.

The report forecasts the demand could increase a further 20% this year, reaching 232 Moz.

Total silver demand fell by 7% last year, from 1,278.9 Moz in 2022 to 1,195.0 Moz in 2023. Silver Institute expects it to rise again in 2024, by 2% to 1,219.1 Moz.

Despite the decrease in demand in 2023, the report said that for the third year in a row, silver demand massively exceeded supply. Silver Institute recorded a deficit of 184.3 Moz, which is 30% less than last year's likely all-time-high.

“It was still one of the largest figures on record,” said the Silver Institute. “Crucially, last year’s deficit coincided with a year in which we experienced sharp declines in bar and coin investment, jewelry and silverware demand that meant global silver offtake fell overall year-on-year. The silver market’s deficit conditions have so far been resilient to pressures from the weaker price elastic elements of demand.”

Silver demand across all industrial use rose by 11% to 654.4 Moz in 2023, which is a record high. The report said “this was mainly due to the structural gains from green economy applications, particularly in the PV sector.”

“It was PV’s capacity additions, well above expectations and accelerated adoption of new generation cells, that helped drive the significant growth of 20% for electronics & electrical demand,” the report said, adding that overall industrial demand for silver is expected to grow by 9% in 2024, reaching 710.9 Moz.

Silver Institute Chair Philips S. Baker Jr. wrote in the report’s introduction that solar is one of the fastest growing uses of silver in the world. “Silver is an essential and critical metal for the future, especially in green energy applications,” he said.

The average price for silver stood at $23.35 per ounce in 2023, up from $21.73 per ounce in 2022.