https://fr.finance.yahoo.com/news/surge ... 00282.htmlSurge Announces Highest Grade Lithium Clay Resource in the USA With 4.67 Mt LCE @2,839 PPM Li Including 4.07 Mt LCE @ 3,167 PPM Li

Newsfile Corp.

jeu. 22 février 2024

West Vancouver, British Columbia--(Newsfile Corp. - February 22, 2024) - Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) (FSE: DJ5) (the "Company" or "Surge") is pleased to report a maiden Mineral Resource Estimate (MRE) on its Nevada North Lithium Project (NNLP). The MRE, which has an effective date of February 16, 2024, was prepared by Dr. Bruce Davis, FAusIMM and includes a pit-constrained Inferred Mineral Resource of 4.67 Mt of Lithium Carbonate Equivalent (LCE) grading 2,839 ppm Li at a 1,250 ppm Li cutoff.

Highlights

Highest Grade Lithium Clay Resource in the USA with 4.7Mt LCE grading 2,839 ppm Li at a 1,250ppm cutoff.

MRE includes over 4Mt of LCE grading 3,167 Li PPM at a 2,000 ppm Li cutoff.

Significant Expansion Potential: The MRE only covers a portion of the known footprint of mineralization with substantial potential for growth.

.......................

About the Nevada North Lithium Project

The Company's Nevada North Lithium Project, located in the Granite Range southeast of Jackpot, Nevada 73 km north-northeast of Wells, Elko County, Nevada. The first two rounds of drilling, completed in 2022 and 2023, identified a strongly mineralized zone of lithium bearing clays occupying a strike length of more than 3,500 meters and a known width of up to 950 meters. Highly anomalous soil values and geophysical surveys suggest there is potential for the clay horizons to be much greater in extent. The Nevada North Lithium Project has a pit-constrained Inferred Resource containing an estimated 4.67Mt of Lithium Carbonate Equivalent (LCE) grading 2,839 ppm Li at a 1,250 ppm cutoff.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Découverte d'une ressource en Lithium à haute teneur au Nevada North Lithium Project

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 4 oct 2020 http://www.oleocene.org/phpBB3/viewtopi ... 1#p2310111

Suite à des nouveaux forages exploratoire la ressources en Lithium du projet Zinnwald en Allemagne est multipliée par plus de 4.

Suite à des nouveaux forages exploratoire la ressources en Lithium du projet Zinnwald en Allemagne est multipliée par plus de 4.

https://www.northernminer.com/fast-news ... 003864233/Zinnwald lithium project in Germany now EU’s 2nd largest

POSTED BY: CECILIA JAMASMIE FEBRUARY 21, 2024

Shares in Germany-focused Zinnwald Lithium (LSE: ZNWD) soared on Wednesday after it posted a 445% increase to resources at its the namesake project in the eastern state of Saxony.

The update makes of Zinnwald the second largest hard rock lithium project in the European Union (EU) by both resource size and contained lithium, chief executive Anton du Plessis said in a statement.

Europe’s largest hard rock lithium deposit and the world’s fourth-largest non-brine asset is the Cinovec lithium project in the Czech Republic, owned by European Metals (LSE: EMH; ASX: EMH) and state-controlled utility CEZ.

Zinnwald’s stock climbed more than 41% on the news, closing at 7.55 pence on Wednesday. This leaves the company a market capitalization of £35.84 million (US$45.2 million).

The project’s latest resource estimate incorporates 26,911 metres of new diamond core drilling across 84 drill holes and a reinterpreted and updated geological model since the previous estimate, released in 2018, the company said.

The project, located in the heart of Europe’s chemical and car industries, about 35 km from Dresden, is expected to produce battery grade lithium carbonate, lithium hydroxide and lithium fluoride (Li2CO3, LiOH, LiF) or a combination of them.

Prices for lithium are down more than 80% from their 2022 peak due to slowing growth in electric vehicle sales, including in the top EV consumer China, and a market oversupply.

https://uk.marketscreener.com/quote/sto ... -45996577/Zinnwald Lithium hard rock project becomes 2nd largest in EU

February 21, 2024

Zinnwald Lithium PLC - High Wycombe, England-based, Germany-focused lithium development company - Issues an updated independent Mineral Resource Estimate for its 100% owned Zinnwald lithium project located in Saxony, eastern Germany. It says the 2024 MRE update incorporates 26,911 metres of new diamond core drilling across 84 drill holes and a reinterpreted and updated geological model since the previous MRE which was released in September 2018. Zinnwald highlights a 445% increase in tonnes and a 243% increase in contained lithium in the measured and indicated category versus the previous 2018 MRE.

Chief Executive Anton du Plessis says: "This establishes the project as the second largest hard rock lithium project by both resource size and contained lithium in the EU and clearly highlights its scale and strategic importance."

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 13 mars 2022 http://www.oleocene.org/phpBB3/viewtopi ... 5#p2339155

Le minier Sayona Mining Limited annonce les résultats de son étude de faisabilité du projet Moblan Lithium au Nord Quebec.

C'est du hard rock Lithium.

Le minier Sayona Mining Limited annonce les résultats de son étude de faisabilité du projet Moblan Lithium au Nord Quebec.

C'est du hard rock Lithium.

https://www.newswire.ca/news-releases/m ... 85350.htmlOBLAN LITHIUM PROJECT FEASIBILITY STUDY: POSITIVE RESULTS DELIVER C$2.2B NPV

SAYONA Feb 19, 2024,

North American lithium producer Sayona Mining Limited ("Sayona") (ASX: SYA) (OTCQB: SYAXF) announced today a feasibility study (FS) that demonstrates the value of its Moblan Lithium Project, forming the centrepiece of the Company's Eeyou Istchee James Bay Hub in northern Québec, Canada. Moblan is owned 60% by Sayona and 40% by Investissement Québec.

The Project has an estimated post-tax NPV(8%) of C$2.2 billion. The operation is expected to generate estimated total net revenue of C$14.4 billion over its 21.1 LOM, with an EBITDA of C$11.2 billion.

These positive financial returns have been driven by an estimated head grade of 1.36% Li2O, a LOM recovery rate of 74.7% and LOM average annual concentrate production of 300,000tpa at a grade of 6% Li2O.

Moblan is a greenfield project situated in the Eeyou Istchee James Bay territory in north-western Québec, Canada. It is located within just 300 metres of the Route du Nord, a regional highway which is accessible year-round, providing access to railway lines that link with major ports in Eastern Canada.

The Project's key production parameters include a relatively low strip ratio of 2.3:1 (ore versus waste), expected product grade of 6% Li2O, and an estimated operating unit cost outlined in the FS are comparable with some of the most cost competitive international hard-rock lithium mines currently in production, supporting an extremely robust future for Moblan. Upon receipt of the necessary regulatory approvals, delivery of an appropriate financing package based on securing potential offtake and project partners, the Project is expected to require approximately two years to complete construction.

...........................

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 9 juillet 2023 http://www.oleocene.org/phpBB3/viewtopi ... 6#p2373126

https://www.mining.com/newly-created-cr ... hium-mine/Newly created Critical Metals on track to construct EU’s first battery-grade lithium mine

Amanda Stutt | March 1, 2024

The company that owns Europe’s first fully permitted lithium mine made its debut with a bang on the Nasdaq this week, as European Lithium (ASX: EUR) merged with Sizzle Acquisition Corp to create Critical Metals Corp (Nasdaq: CRML). After Sizzle stock saw a 120% surge in after hours trading Tuesday, Critical Metals debut on the Nasdaq Wednesday morning fizzled, tanking 38%.

On Friday by midday, CRLM was up over 10%. European Lithium shareholders still have a $1.2 billion stake in the Wolfsberg lithium project in Carinthia, Austria, set to become the EU’s only producing battery-grade lithium mine by 2027, according to Critical Metals executive chairman Tony Sage.

Sage is unfazed by both the drop in company shares during Wedneday’s debut, and by the current lithium price lows.

The company has secured supply agreements with BMW, and a deal ith Obeikan Investment Group to build a lithium hydroxide plant in Saudi Arabia. The 50:50 joint venture will be geared towards constructing, commissioning and operating the plant for the conversion of lithium spodumene concentrate.

“It’s a strategic plan. Wolfsberg is going to go through a two year construction phase — the next step is for finalising the Saudi deal, we expect by the end of March, ” Sage told MINING.com in an interview.

Sage is also eyeing rare earths and uranium projects, both brownfield and greenfield in the EU. European lithium already has a 7.5% stake in the Tanbreez rare earth project in Greenland, majority owned by Rimbal. With a 28.2 million tonne TREO resource, Tanbreez is ranked biggest rare earth project in the world.

Following construction at Wolfsberg by 2026, Critical Metals has agreed to supply BMW by 2027.

“I think if you’re in production now, you’re in a little bit of a problem, but we’re going to come out of the construction phase at the right time, supplying BMW. If you look at all the forecasts of every research house — It’s going to be a squeeze around that time, so prices should be up,” Sage said.

European Lithium produced a definitive feasibility study for Wolfsberg in 2023, but Sage pointed out the construction of the hydroxide plant now may be cheaper than what was in the original DFS and the OPEX numbers have improved.

Wolfsburg is fully permitted in perpetuity as long as work is ongoing, slated to be the next producing lithium mine in the EU, and the first to produce battery grade.

The pivotal role of lithium-ion batteries in the electric-vehicle revolution is driving the construction of about half a dozen refinery projects across Europe. At the same time, the strategic importance of those developments has been underlined by the European Union’s initiative to cut its dependence on China for critical raw materials. Europe’s only current lithium supply is from Portugal, but it is used only in ceramics.

Rio Tinto’s plans for a $2.4 billion Jadar lithium project in Serbia fell flat when licences were revoked in January 2022 after protests over environmental concerns about the planned mine. Serbia Serbian Prime Minister Ana Brnabic said she does not see a chance of reviving the project.

“We’re lucky that we’ve got our permit in place and that the Austrian Government is keen on our project,” Sage said. “It’s just a dichotomy when you’ve got the head bodies saying ‘we want this’ and then local governments are not allowing permits to happen.”

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/sqm-profit-d ... ces-slide/SQM profit down 82% as lithium prices slide

Reuters | February 28, 2024

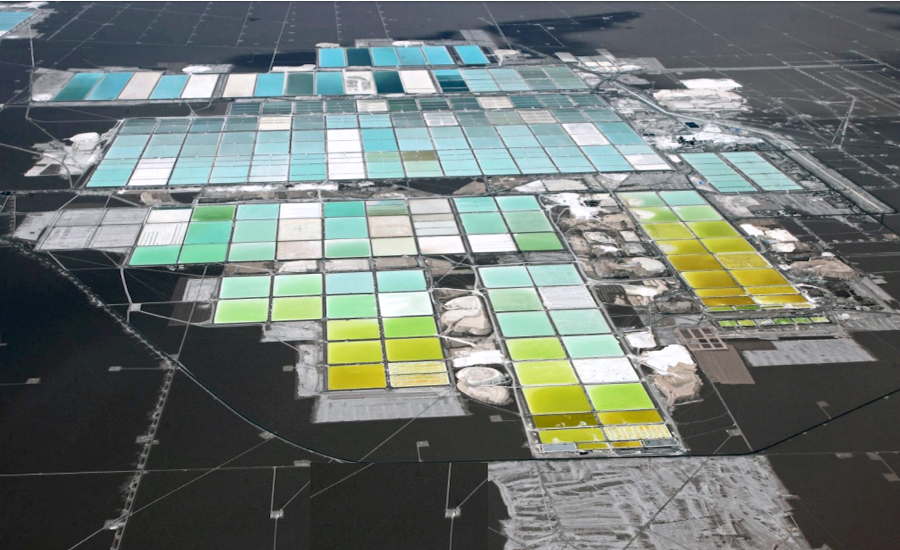

SQM evaporation ponds in Atacama, northern Chile. (Image courtesy of SQM)

Chile’s SQM, the world’s second-largest lithium producer, on Wednesday posted an 82% fall in its fourth-quarter net profit from a year earlier, below forecasts as prices for the key battery metal continued to slide from earlier peaks.

The miner, which also produces fertilizers and industrial chemicals, reported a quarterly net profit of $205.9 million, below the $317 million expected by analysts polled by LSEG, after a gradual slide in earnings over 2023.

Revenue for the period fell 58% to $1.31 billion, also lagging LSEG’s $1.35 billion forecast.

SQM said it sold record-high volumes of lithium during the quarter, hitting around 51,000 metric tons and up nearly 20% from a year earlier, even as average prices dropped 73%.

The company said it expected lithium sales volumes to increase 5%-10% this year, with global demand forecast to rise 20%, although warned that oversupply would hold prices steady.

“The excess in lithium and battery materials … is expected to continue during this year, keeping pressure on lithium market prices,” SQM chief executive Ricardo Ramos said in a statement.

Global supplies for the electric vehicle battery metal outpaced demand over 2023, fuelling a glut that has dragged on prices and caused producers such as Albemarle, the world’s largest supplier, to cut jobs and pause expansions.

SQM said it expected to produce 210,000 tons of lithium carbonate in the first quarter this year as it ramps up its Chile operations, adding that 2024 capital expenditure would come to about $1.3 billion.

The group’s share price has slid around 30% in the last 12 months.

SQM also said it is working with communities in Chile’s Atacama region as it finalizes details of its agreement with state-run miner Codelco, signed in December, as part of a government plan to boost the state’s role in the lithium sector.

The deal triggered protests by local indigenous groups who blocked roads to SQM, causing a pause in operations.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://oilprice.com/Energy/Energy-Gene ... Brine.htmlSaudi Arabia and UAE Look To Extract Lithium from Oilfield Brine

By Charles Kennedy - Mar 08, 2024,

Saudi Aramco and Abu Dhabi National Oil Company (ADNOC), the state oil giants of two of OPEC’s top producers, are in very early stages of working to extract lithium from the brine in their huge oilfields in the Middle East, Reuters reported on Friday, citing three anonymous sources with knowledge of the plans.

The two major Gulf oil producers have been seeking to diversify their revenues streams and tap other profitable operations apart from oil, to fund their massive state programs and, in Saudi Arabia’s case, the Vision 2030 plan of Crown Prince Mohammed bin Salman, which includes billions of U.S. dollar spending on futuristic projects in the Saudi deserts.

Aramco and ADNOC will be using some kind of direct lithium extraction (DLE) technology, the sources told Reuters but declined to elaborate.

DLE avoids open-pit mining or the traditional process of extracting lithium from brine through evaporation ponds, but the technology is in its early stages.

If Aramco and ADNOC do go for lithium extraction, they wouldn’t be the first oil giants to do so.

U.S. supermajor ExxonMobil has made inroads into the lithium extraction industry. While doubling down on crude oil production, especially closer to home, ExxonMobil unveiled plans in November to produce lithium in Arkansas, aiming to become a leading supplier of the key metal for electric vehicles (EVs) by 2030. The company has already begun work on a first phase of its North American lithium production in southwest Arkansas, an area known to hold significant lithium deposits.

The current lithium market and economics are depressing for the industry, but the long-term prospects for the key battery metal remain bright.

In the lithium market, slowing growth in electric vehicle sales and an oversupply sent lithium prices crashing by 80% in the past year, prompting lithium miners to pause and scale back expansion projects.

The crash in lithium prices is holding back reinvestment in new supply, the world’s largest lithium producer, Albemarle, says.

Yet, the deferral of new supply developments amid the low prices is setting the stage for the next lithium supply crunch later this decade, according to executives and analysts.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, une flambée en perspective?

La fiche usgs 2024 pour le Lithium : https://pubs.usgs.gov/periodicals/mcs20 ... ithium.pdf

Sans surprise, trés grosse augmentation de la production.

Data in metric tons of lithium content

mon post de l' an dernier : http://www.oleocene.org/phpBB3/viewtopi ... 6#p2363056

La production miniére à doublée par rapport à 2019 ! voir http://www.oleocene.org/phpBB3/viewtopi ... 2#p2316402

Sans surprise, trés grosse augmentation de la production.

Data in metric tons of lithium content

mon post de l' an dernier : http://www.oleocene.org/phpBB3/viewtopi ... 6#p2363056

La production miniére à doublée par rapport à 2019 ! voir http://www.oleocene.org/phpBB3/viewtopi ... 2#p2316402

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

Pas mal de Lithium au Kazakhstan

https://oilprice.com/Energy/Energy-Gene ... dmine.html

..............

Speaking at a conference in Seoul on March 5, researchers from the Korea Institute of Geoscience and Mineral Resources announced that they had discovered sizable lithium reserves in an area of eastern Kazakhstan.

Experts from the Korea Institute of Geoscience and Mineral Resources, or KIGAM, quoted by The Korea Times said mineral deposits in the 1.6 square kilometer Bakennoye deposit, where tantalum was previously mined and which has been subject of exploration work since May, contains mineral resources worth up to $15.7 billion.

KIGAM reportedly intends to apply jointly with a South Korean company for permission to conduct further drilling investigations at the site next year.

That discovery stands to consolidate Kazakhstan’s position as a strong emerging source of lithium.

.........................

https://oilprice.com/Energy/Energy-Gene ... dmine.html

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 5 nov 2023 http://www.oleocene.org/phpBB3/viewtopi ... 1#p2379661

https://www.mining-technology.com/news/ ... m/?cf-viewFrontier Lithium and Mitsubishi form JV for lithium operations in Canada

Under the deal, Mitsubishi will acquire an initial 7.5% stake in the project for C$25m ($18.4m)

Annabel Cossins-Smith March 4, 2024

Canadian miner Frontier Lithium will form a joint venture (JV) with Japanese conglomerate Mitsubishi Group to boost lithium mining and processing in Ontario, Canada.

The JV will look to advance operations at Frontier Lithium’s PAK lithium mine project, the second-biggest lithium mine by size in North America, and a planned lithium chemicals conversion facility, the company said in a press statement published on Monday.

The deal was signed on Saturday. Under the agreement, Mitsubishi will acquire an initial 7.5% stake in the project for C$25m. After a definitive feasibility study (DFS), Mitsubishi will have the right to increase its interest in the JV to 25% through the purchase of additional shares at a price based on the net value of the project, which will be determined through the DFS, Frontier Lithium said.

Frontier Lithium CEO Trevor Walker called the deal a “significant milestone” for the company as it looks to become a key lithium supplier to the North American electric vehicle battery materials supply chain. “Mitsubishi’s investment reflects confidence in Ontario’s jurisdiction, the quality and scale of our asset, and Frontier’s operational expertise.”

Kota Ikenishi, general manager of the battery minerals office at Mitsubishi, added: “PAK is an outstanding lithium project, and we recognise its strategic value in ensuring a secure supply of lithium to North American markets. We are excited to build a long-term relationship with Frontier and leverage our complementary skills and capabilities to deliver PAK into production.”

The move comes after a recent memorandum of cooperation was signed between the governments of Canada and Japan to work more closely to establish sustainable and reliable global battery supply chains independent of Chinese influence.

The companies hope to generate investments in the upstream, midstream and downstream sectors, including the mining and processing of lithium and other critical minerals, which are essential to the making of energy transition technologies.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 3 dec 2023 http://www.oleocene.org/phpBB3/viewtopi ... 3#p2381133

https://www.mining.com/joint-venture/jv ... september/Argentina Lithium targets first resource by September

MINING.COM and Argentina Lithium | March 7, 2024

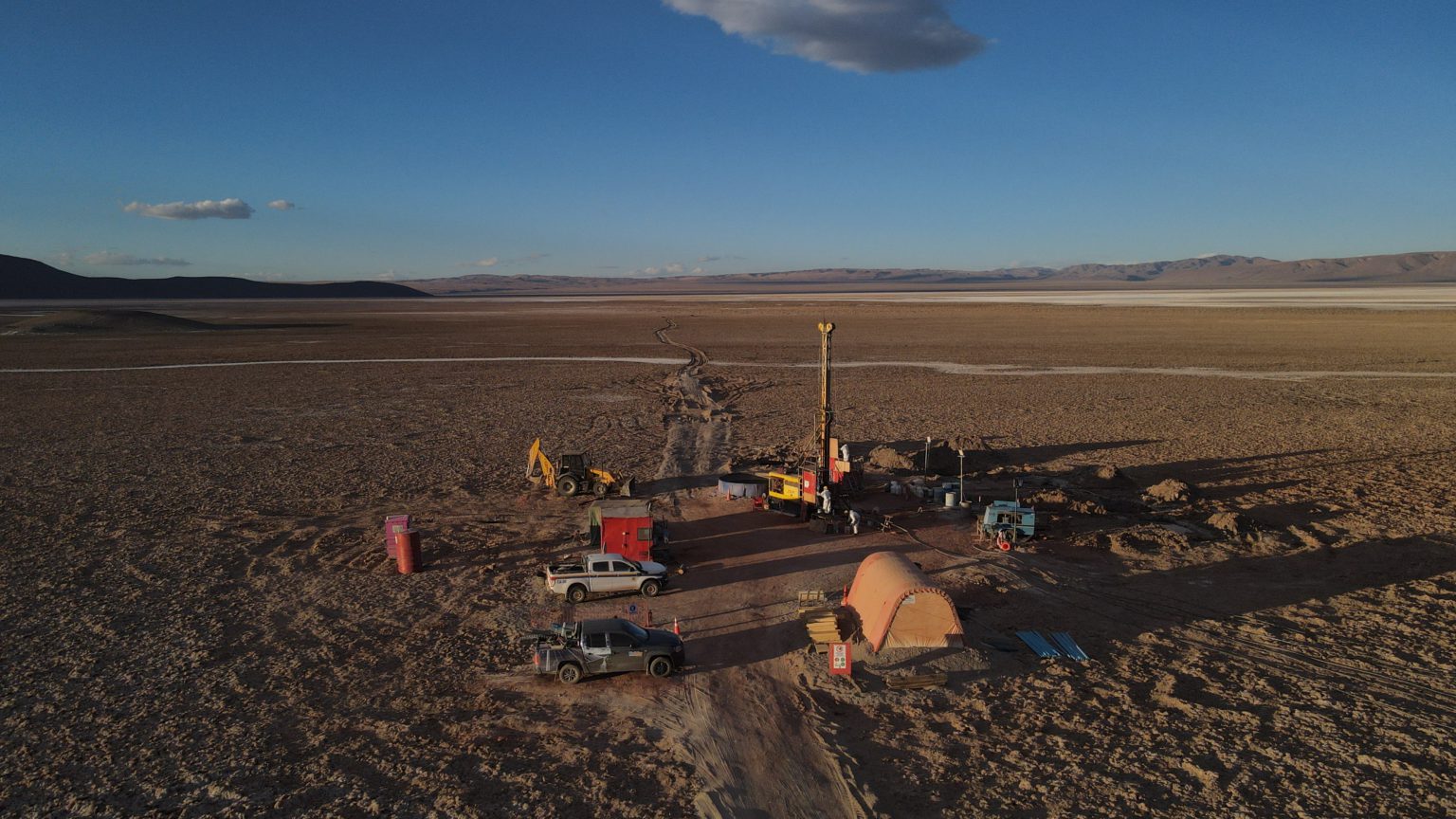

A drill platform at the Rincon West project. Credit: Martin Diaz Russo.

Argentina Lithium & Energy (TSX-V: LIT; US-OTC: LILIF), backed by Chrysler automaker Stellantis, says it’s drilling the Rincon West lithium brine project, located beside a Rio Tinto (NYSE: RIO; LSE: RIO; ASX: RIO) venture, for an initial resource estimate in September.

Stellantis, which also owns Fiat and Peugeot, has invested $90 million (paid in Argentine pesos, valued at approximately $45 million after conversion) for a 19.9% stake in Argentina Lithium & Energy. The manufacturer is keen for the 15,000 tonnes per year in lithium carbonate offtake to supply its battery plants planned across the Americas.

Representative of recent results at Rincon West, drill hole RW-DDH-010 tested a 295.5-metre interval ranging from 245 to 366 mg per litre lithium. Eleven holes were drilled last year and four more holes are planned to extend over the nearby salt flat at the project.

“Drilling is confirming our initial hypothesis, that the concentrated lithium brines tested by our neighbour in the central salar also extend to our west-side properties. Future drilling will test whether the same is true for our northern and eastern blocks on the same basin,” Miles Rideout, vice-president of exploration, said by phone from Mendoza, 1,000 km west of Buenos Aires. “The project’s first resource, due this year, should prepare us for a prefeasibility study in 2025.”

...........................

Rincon West is located about 3,760 metres above sea level in the arid Alto Plano region of Salta Province, Argentina, bordering Chile

............................

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 4 juin 2023 http://www.oleocene.org/phpBB3/viewtopi ... 0#p2370810

https://finance.yahoo.com/news/lithiumb ... 00008.htmlLithiumBank Reports >3,000 mg/L Lithium and >98% Recovery from Direct Lithium Extraction Test Work

November 22, 2023·

LithiumBank Resources Corp. is pleased to announce results from bench-scale G2L Greenview Resources Inc. ("G2L") - Direct Lithium Extraction (DLE) test work on brine from its Boardwalk Lithium Brine Project. The Boardwalk Project is located in west-central Alberta, Canada, and situated on 100% owned crown mineral rights.

............................

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 19 novembre 2023 http://www.oleocene.org/phpBB3/viewtopi ... 5#p2380375

https://www.boursorama.com/actualite-ec ... b2cccca6c2En Bosnie, du lithium, du magnésium et quelques doutes

AFP•14/03/2024

Un gisement qui tombe à pic, la promesse de milliers d'emplois, et une mine à ciel ouvert : autour de Lopare, en Bosnie, le sol est riche de magnésium et de lithium, matières premières critiques en Europe. Mais leur extraction inquiète.

Le sol argileux de cette région vallonnée du nord-est du pays, un des plus pauvres d'Europe, a été exploré ces dernières années par la société suisse Arcore AG, qui souhaite approvisionner le gourmand marché européen.

On y trouve "des quantités exceptionnellement intéressantes [de matières premières] pour la chaîne d'approvisionnement de l'Union européenne", plaide auprès de l'AFP le directeur la filiale d'Arcore en Bosnie, Vladimir Rudic.

Les réserves du gisement sont estimées à 1,5 million de tonnes d'équivalent de carbonate de lithium, 94 millions de tonnes de sulfate de magnésium et 17 millions de tonnes de bore, utilisé notamment dans la fabrication d'éoliennes.

La découverte de ces matières premières, indispensables à l'industrie européenne et à la transition énergétique, ravit les industries mais divise l'opinion et les partis politiques: "une chance pour le développement" du pays pour les uns, un risque pour l'environnement pour les autres.

"La mine de Lopare devrait lancer la production début 2027, commencer à tourner à plein régime entre 2030 ou 2032", et produire à ce moment 10.000 tonnes de carbonate de lithium par an, explique M. Rudic. De quoi fabriquer entre 150.000 et 200.000 batteries pour les voitures électriques, selon des experts.

Si le gisement est à "faible teneur" en lithium, son extraction reste intéressante, explique M. Rudic. Et la présence importante de magnésium et de bore garantit une "stabilité" dans la durée à la future mine.

- "Chance de développement" -

Arcore, qui entend demander une concession d'exploitation pour une période de 50 ans, table sur ses recettes annuelles d'un milliard d'euros et la création d'environ 1.000 emplois directs, et plus de 3.000 indirects.

Avec à l'horizon l'interdiction de la vente de véhicules thermiques dans l'UE à partir de 2035, l'Europe a un besoin vital de réduire sa dépendance à la Chine pour le lithium.

Quant au magnésium, l'UE dépend de la Chine pour 97% de ses besoins.

Milorad Dodik, président de la Republika Srpska, l'entité serbe de Bosnie dont Lopare fait partie, s'est dit favorable à l'exploitation, "une chance de développement qu'il ne faut pas rater". Tout en assurant qu'il ne s'agissait pas d'un permis de polluer.

L'exploration du gisement ces dernières années n'a pas soulevé beaucoup d'opposition. La levée de boucliers a eu lieu après l'annonce à l'automne du plan d'ouverture d'une mine à ciel ouvert à proximité de la ville. Le conseil municipal a voté en décembre une motion contre le projet.

Le maire de Lopare, Rado Savic, en est certain: "plus de 90% des habitants sont contre l'exploitation", affirme-t-il. "Les gens ont peur de fuites de matières toxiques (...) Nous sommes clairs: nous ne souhaitons pas une telle mine ici".

L'édile redoute une "détérioration encore pire de la démographie" de sa localité, où il ne reste plus que 8.500 habitants, contre 15.000 enregistrés au recensement de 2013.

- Tôt ou tard la pollution" -

Plusieurs ONG écologistes s'alarment du possible impact sur l'environnement, et une pétition contre l'ouverture de la mine, signée par 3.700 personnes, a été remise fin février au parlement de la Republika Srpska.

"Partout dans le monde où il a y a ce genre de mines il y a aussi, tôt ou tard, la pollution des eaux souterraines et de l'air", dit Snezana Jagodic Vujic, présidente de l'association "Eko Put", en évoquant les "grandes quantités" d'eau et de réactifs nécessaires à l'extraction du lithium.

Vladimir Rudic accuse les opposants de "semer la panique". "Les conditions d'exploitation seront absolument contrôlées" et le traitement du minerai se fera "dans les cycles industriels fermés", assure-t-il.

Une étude d'impact sur l'environnement doit être réalisée après l'obtention éventuelle de concession d'exploitation, et suivie d'un débat avec la population.

Pour les habitants croisés à Lopare, la question est déjà réglée.

La ville sera "recouverte d'une énorme couche de poussière, sans parler de l'impact sur les eaux souterraines", prévoit Jovan Jovic, un pharmacien au chômage.

Quant à Milivoje Tesic, vétéran de 63 ans, il ira "défendre physiquement (sa) terre et (son) calme".

"Si nous devenons le Koweït, alors OK. Mais montrez-moi un exemple où un investisseur étranger est entré dans un pays et y a fait un progrès."

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 1er oct 2023 http://www.oleocene.org/phpBB3/viewtopi ... 6#p2377616

https://electrek.co/2024/03/14/north-am ... -26b-loan/North America’s largest lithium mine is full steam ahead – it just got a $2.26B loan

Michelle Lewis Mar 14 2024

Great news for EVs: Lithium Nevada got the green light for a $2.26 billion loan from the US Department of Energy to finance a lithium carbonate processing plant.

Once the Thacker Pass mine and processing plant in Humboldt County are online, they will become North America’s largest source of lithium for EV batteries.

The Thacker Pass processing plant will produce around 40,000 tonnes of lithium carbonate annually for the use of EV lithium-ion batteries. That’s enough for up to 800,000 EVs. The project’s goal is to eventually produce 80,000 metric tons per year.

Construction at the Thacker Pass mine site started in March 2023 after Lithium Nevada won a court case against ranchers, conservationists, and Indigenous communities. Once the loan closes, a three-year-long construction process will start.

If finalized, the loan will be offered through the Advanced Technology Vehicles Manufacturing (ATVM) Loan Program.

The massive project is expected to create around 1,800 jobs during construction and 360 jobs in operations.

General Motors is expected to be a long-term primary lithium carbonate buyer for the project. The automaker invested $650 million in Thacker Pass in 2023, making it the largest shareholder in Lithium Nevada’s parent company, Lithium Americas.

The DOE’s Loan Programs Office says in its Thacker Pass loan announcement that “developing this project will strengthen domestic battery supply chains and reduce reliance on unreliable foreign sources.”

The mine and processing plant are expected to be fully online in 2028.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 18 dec 2022 http://www.oleocene.org/phpBB3/viewtopi ... 0#p2359520

https://www.mining-technology.com/news/ ... ners-ntec/Arizona Lithium partners NTEC for Big Sandy lithium project

NTEC will be tasked with management of permitting requirements, environmental assessments and exploration drilling.

March 11, 2024

Arizona Lithium has signed a binding mining services agreement with Navajo Transitional Energy (NTEC) for development and production at the Big Sandy Lithium Project in Arizona.

The collaboration leverages NTEC’s extensive mining and energy project experience.

The company will be tasked with management of permitting requirements, environmental assessments, exploration drilling, mine design and development, through to the launch of mining operations.

NTEC, owned by the Navajo Nation, has a notable presence in the mining sector, with operations in the Navajo Mine and involvement in the Four Corners Power Plant.

The company’s expertise spans various states including Montana and Wyoming, and it is committed to fostering the development of the Navajo Nation’s resources.

Additionally, as part of the latest agreement, NTEC CEO Vern Lund, with more than 25 years in the mining industry, will become a member of the Arizona Lithium board.

Lund’s expertise encompasses operational management, business development and new project development, and promises to be a valuable asset to the Big Sandy Lithium Project.

In December 2022, Arizona Lithium announced the inception of this collaboration through a Strategic Alliance Term Sheet with NTEC.

The recent mining services agreement solidifies the terms initially set forth.

Arizona Lithium managing director Paul Lloyd said: “We are very pleased to have signed a Mining Services Agreement with NTEC, which formalises the terms initially agreed to under the Strategic Alliance Term Sheet announced in December 2022.

“NTEC is the ideal operating partner for Big Sandy and will take over the operational development of Big Sandy, being responsible for managing the permitting requirements, exploration drilling, mine design, environmental assessments and development through to commencement of mining operations for the project.

“Big Sandy represents a substantial development opportunity holding 320,800 tonnes of LCE, with only 4% of the project drilling, providing significant exploration upside once permitted.”

A very shallow, flat lying mineralised sedimentary lithium resource, Big Sandy Project has 32.5 million tonnes (mt) indicated and inferred JORC resource, grading 1,850 parts per million lithium for 320,800t Li2CO3 (lithium carbonate), as estimated after a 2019 drill programme.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

https://www.mining.com/web/lithium-perm ... ince-says/Lithium permit freeze limited to new projects, Argentina province says

Bloomberg News | March 15, 2024

The Argentine province of Catamarca said a court ruling to halt the awarding of lithium permits only affects new projects, leaving companies such as Arcadium Lithium Plc and Posco Holdings Inc. free to continue producing the metal and developing existing projects.

The ruling, which comes amid community concerns over mining’s impact on waterways, requires the Catamarca government to abstain from handing out new licenses as it prepares a report into the industry’s environmental impact, a provincial official said. The province’s first step will be to deliver to the court existing environmental reports that have already been approved.

The court’s decision, which follows a suit filed by an Indigenous group, covers the Los Patos River-Salar del Hombre Muerto area, home to some of country’s biggest lithium deposits. While four projects awaiting licenses will be affected by the permitting freeze, existing operations and projects already under development can continue as normal, the official said.

Still, the case underscores heightened environmental and social scrutiny on an extraction method that involves pumping up huge volumes of lithium-laced brine from South American salt flats, with much of the water lost in an evaporation process. The industry’s ability to prove its green credentials is crucial as demand for the battery metal accelerates in the shift toward electric vehicles.

Arcadium, formed from the merger of Livent Corp. and Allkem Ltd., declined to comment as it prepares a statement on the court ruling.