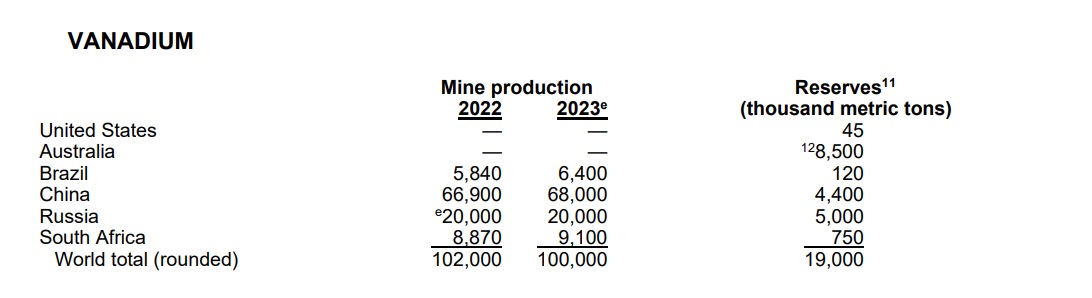

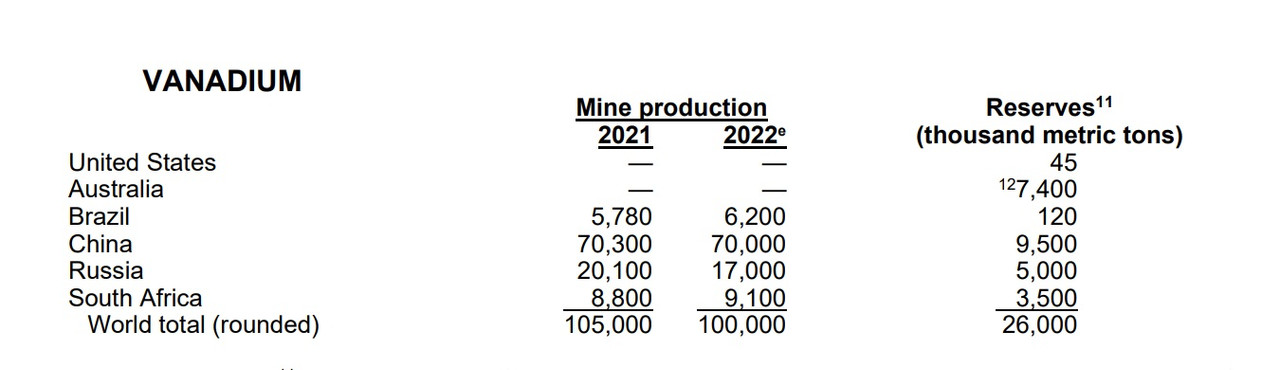

Data in metric tons of contained vanadium unless otherwise noted)

mon post de l' an dernier : viewtopic.php?p=2337069#p2337069

Modérateurs : Rod, Modérateurs

https://www.nsenergybusiness.com/news/a ... ing-plant/AVL appoints Wood for vanadium pyrometallurgical processing plant

By NS Energy Staff Writer 20 Feb 2023

The ECI process, which will involve the development of the design and execution strategy for the pelletisation and roasting area of the vanadium extraction process, will run through until Q2 2023

Australian Vanadium (AVL) has appointed Wood Minerals and Metals to undertake the early contractor involvement (ECI) services for the Australian vanadium project pyrometallurgical processing plant.

The ECI process will involve the development of the design and execution strategy for the pelletisation and roasting area of the vanadium extraction process. It will run through until the second quarter of this year.

Besides, it will include revising the expected capital expenditures and operating expenditures and updating the materials take-off as required along with updating and finalising the process design criteria.

AVL said that it is moving towards the final design for the plant to be located at Tenindewa, east of Geraldton in Western Australia.

The Australian vanadium project is an open-pit vanadium mine being developed near Meekatharra, Western Australia. It consists of 15 tenements spanning an area of nearly 200km2 and is fully-owned by the company.

As a result of the project’s significance as a battery and critical metal initiative, the Australian government granted it federal major project status in 2019, while the Western Australian government gave it state lead agency status in 2020.

The associated vanadium pentoxide processing plant will be situated inland from the port city of Geraldton, while the open cut mine and concentrator will be located south of Meekatharra.

AVL CEO Graham Arvidson said: “AVL has worked with Wood for several years and has been impressed by the high quality of technical work that the team has undertaken.

“Having someone who fully understands the pyrometallurgical requirements for vanadium processing is essential for a successful outcome. We are very pleased to be working with the Wood team on this ECI phase for the processing plant.”

As part of the process to accelerate long lead time and critical equipment, preferred vendors will be identified and pre-qualified for delivering key pyrometallurgical equipment, stated AVL.

https://www.nsenergybusiness.com/news/i ... -in-vecco/Idemitsu increases investment in Vecco

The Debella PJ first aims to launch a vanadium electrolyte manufacturing plant (35MWh capacity) for redox flow batteries within the current year

By NS Energy Staff Writer 27 Mar 2023

Idemitsu Kosan Co.,Ltd. (Head Office: Chiyoda-ku, Tokyo; Representative Director, President and Chief Executive Officer: Shunichi Kito, hereinafter referred to as “Idemitsu”) has made an additional investment of AUD$8.26 million*1 in Vecco Group Pty Ltd. (head Office: Brisbane), which promotes a vanadium project in Australia. Together with the initial investment made in October last year, Idemitsu’s total investment amounts to AUD$13.16 million, representing a shareholding of 14.7%. Through this investment, Idemitsu will promote knowledge-gaining efforts in the rare metals business and accelerate the development of businesses that will contribute to the introduction of renewable energy and the realization of a low-carbon society.

Vecco is working on a project related to a vanadium mine and an electrolyte plant (Project name: Debella Project, hereinafter “Debella PJ”) in Queensland, Australia. The Debella PJ aims to build a value chain of local production and local consumption, including the mining of vanadium, its refining into vanadium pentoxide, and the production of vanadium electrolyte for redox flow batteries. Vecco expects to raise an additional AUD$10 million in total through this capital increase, with the funds to be used for project feasibility studies, environmental approvals, refining and refining testing, and mining area application costs. A portion of the funds will also be earmarked for research and development of final products.

A redox flow battery is a battery that stores energy in an electrolyte. With characteristics suitable for large storage batteries for power systems, such as easy expansion and long life, these batteries are attracting attention as contributing to the promotion of the introduction of renewable energies.

The Debella PJ first aims to launch a vanadium electrolyte manufacturing plant (35MWh capacity) for redox flow batteries within the current year. This will be the first commercial-scale electrolyte manufacturing facility in Australia, and its construction will be supported by the Queensland State Government’s Industry Partnership Program*2, a public-private partnership program related to the promotion of the storage battery industry. In the future, the company plans to increase its vanadium electrolyte production capacity to 350 MWh or more per year. The goal is to begin mining vanadium through mine development by the end of 2024.

https://www.agenceecofin.com/metaux/050 ... um-rapportEn 2022, le stockage d’énergie est devenu le deuxième plus gros consommateur de vanadium (rapport)

Agence Ecofin 5 juin 2023

L’acier est de loin le plus gros consommateur de vanadium. Cependant, l’intérêt croissant que suscitent les batteries au vanadium pourrait entrainer une augmentation de la demande de ce minéral. L’Afrique du Sud, la Namibie, la Mauritanie ou encore le Maroc surveillent de près le marché.

L’utilisation du vanadium dans le stockage de l’énergie a connu en 2022 une croissance en glissement annuel de 42 %. Si l’on en croit les données de l’organisation Vanitec relayées par Mining Review, cette croissance permet au secteur du stockage de l’énergie de devenir pour la première fois de l’histoire, le deuxième plus grand consommateur de vanadium, avec 4,3 % de la consommation mondiale.

Alors qu’environ 90 % du vanadium produit dans le monde continue d’être utilisé par le secteur de l’acier selon un rapport du même organisme, la part consommée par le stockage d’énergie n’a cessé de croître sur les dernières années. Le secteur consomme désormais plus de vanadium que les produits chimiques et catalyseurs ou encore les alliages de titane.

Pour Vanitec, cette augmentation s’explique principalement par la croissance rapide de l’utilisation de la technologie VRFB (Vanadium Redox Flow Battery) qui permet de stocker de plus grandes quantités d’énergie renouvelable. Elle reflète la reconnaissance du grand rôle que peut jouer ce composé sur le marché du stockage par plusieurs gouvernements, y compris ceux de la Chine, de l’Australie, du Canada ou encore des États-Unis. Plusieurs pays, dont ceux de l’UE, les États-Unis, le Canada, l’Australie, le Japon, le Brésil, l’Afrique du Sud et le Royaume-Uni, classent d’ailleurs aujourd’hui le vanadium comme un minéral essentiel.

Quelles perspectives ?

Pour le cabinet Guidehouse Insights, les déploiements annuels mondiaux de systèmes VRFB devraient atteindre environ 32,8 GWh par an d’ici à 2031, soit un taux de croissance annuel composé (TCAC) de 41 %. Selon John Hilbert, PDG de Vanitec, l’utilisation accrue du minéral dans le stockage de l’énergie devrait faire augmenter la consommation de vanadium dans les prochaines années.

Ce sentiment semble partagé par plusieurs firmes d’analyse, y compris Fastmarkets qui reconnait, dans une récente note, un développement et une utilisation accrus des batteries au vanadium. Ces dernières seraient plus rentables à long terme compte tenu de leur cycle de vie plus long que celui des autres systèmes de stockage.

Cependant, la firme a relevé quelques obstacles qui pourraient entraver leur expansion, avec en tête de liste le coût de construction d’un projet de stockage d’énergie à base de vanadium, « nettement supérieur au coût de construction d’un projet à base de lithium ». « La fabrication d’une batterie au vanadium coûte environ 3 000 à 4 000 yuans par kWh, tandis que celle d’une batterie au lithium coûte environ 1 500 yuans par kWh », peut-on lire dans la note, qui cite également comme inconvénients une maintenance plus importante et une efficacité énergétique plus faible. Malgré ces défis à relever, le taux de pénétration des batteries au vanadium pourrait atteindre 5 % d’ici 2025 et 10 % d’ici 2030, d’après un analyste cité par Fastmarkets, qui indique que les batteries au lithium resteront tout de même majoritaires.

https://www.mining-technology.com/news/ ... -vanadium/Neometals and Glencore sign offtake agreement for Finnish vanadium project

Glencore will purchase all the saleable recovered vanadium bearing products from the Vanadium Recovery Project.

July 13, 2023

Australian battery materials producer Neometals has signed an offtake agreement with commodities producer Glencore for all vanadium products developed at the Vanadium Recovery Project (VRP1) in Finland.

Under the agreement, Neometals’ majority-owned subsidiary Novana will be responsible for exclusively selling all the saleable recovered vanadium-bearing products from the VRP1 to Glencore for an initial period of five years.

Neometals said in a statement: “The price payable for the vanadium-bearing products produced and delivered is tied to a prevailing market publication.”

Through a joint steering committee, Glencore will provide technical expertise, including advice and insights, during the VRP1 initial development phases.

Novana is a wholly owned subsidiary of VRP1’s joint venture company, Recycling Industries Scandinavia AB (RISAB).

Neometals owns a 72.5% stake in RISAB while Critical Metals holds the remaining 27.5% stake.

Neometals managing director Chris Reed said: “Securing take-or-pay offtake for 100% of VRP1 vanadium products represents a significant milestone as we progress towards an FID this quarter. Removing volume risk on offtake is seen as a key requirement for securing project finance and we have mitigated this risk with the take-or-pay nature of our offtake agreement with a Tier 1 counterparty in Glencore.

“The offtake agreement further emphasises the anticipated future need for high-purity material in the market. This is supported by significant expected demand from the vanadium redox flow battery sector and other potential high purity applications.”

https://www.nsenergybusiness.com/news/a ... australia/Australian Vanadium agrees to merge with Technology Metals Australia

By NS Energy Staff Writer 25 Sep 2023

The combined company will become a large-scale vanadium developer in Australia, consolidating two adjoining projects across one orebody and facilitating the operational and corporate synergies by creating a single integrated project

Australian Vanadium (AVL), which operates the Australian vanadium project, has signed a binding Scheme Implementation Deed (SID) to merge with Technology Metals Australia (TMT).

AVL will fully acquire TMT, under a scheme of arrangement, subject to the satisfaction of certain conditions.

Under the terms of the agreement, TMT Shareholders will the Australia-based mineral exploration company receive 12 AVL shares for every TMT share held, which implies an offer price of A$0.324 per TMT share, totalling A$217m ($139m).

The offer represents a 9.8% premium to TMT’s last close price, based on AVL and TMT’s last closing prices of A$0.027 per share and A$0.295 per share respectively.

The merger will consolidate two adjoining projects across one orebody and facilitate the operational and corporate synergies by creating a single integrated project.

The combined company will become a large-scale vanadium developer in Australia.

AVL CEO Graham Arvidson said: “The combination of Australian Vanadium and Technology Metals Australia is transformational for both companies and marks a significant milestone in both management teams’ efforts to develop their respective projects.

“The logical consolidation of two adjoining projects on the same orebody will unlock material synergies for both sets of shareholders.

“If successful, the transaction will create the leading ASX-listed vanadium developer and a world-class asset of scale located in a Tier-1 mining jurisdiction.”

AVL will conduct an institutional placement to raise A$15m to finance the ongoing project and corporate initiatives during the transaction period.

AVL shareholders will hold around 58% of the combined company and TMT shareholders around 42% of the combined company.

The transaction will provide tangible benefits including operational and corporate synergies, enhanced project economics and expansion optionality.

It will consolidate two adjoining projects with a combined mineral resource base representing over 25 years of mine life with opportunities to further extend and expand mine life.

The merger will optimise mine processing schedules, including product blending opportunities, project infrastructure and capital costs.

TMT managing director Ian Prentice said: “We are excited to be proposing the consolidation of the Gabanintha vanadium orebody, arguably one of the best-undeveloped vanadium resources in the world.

“This all comes at a pivotal time for the global vanadium industry as vanadium flow batteries are established as a critical player in the long-duration energy storage market, a key requirement for the world’s transition to net zero and a cleaner future.

“We very much appreciate our major shareholder RCF’s demonstrable support for the vanadium thematic and the development of this world-class asset.”

https://www.mining-technology.com/news/ ... e/?cf-viewRecord of decision obtained for Gibellini vanadium mine in US

The Gibellini project is expected to have an average annual production of 9.65 million pounds of vanadium oxide (V₂O₅).

October 30, 2023

Canada-based Nevada Vanadium Mining has secured a record of decision (ROD) for its Gibellini vanadium project from the US Department of the Interior’s (DOI) Bureau of Land Management (BLM).

The ROD is considered to be a final step in the federal permitting process for the project and follows a review of its impacts along with the participation of local communities, and the US Environmental Protection Agency (EPA).

Gibellini is said to be the first primary vanadium mine in the US and also the nation’s first mine to be entirely powered by renewable energy.

Located 25 miles (40km) from Eureka, Nevada, US, the Gibellini project is solely owned by Nevada Vanadium.

The project includes the Gibellini and Louie Hill vanadium deposits, which are located next to each other.

At Gibellini, critical minerals can be extracted and processed to help realise a low-carbon economy.

The US Government has designated vanadium as a critical mineral of strategic importance to the country. It has several applications as an alloy and a catalyst across several industries including aerospace, defence, energy and infrastructure.

This project is expected to have an average annual production of 9.65 million pounds of vanadium oxide (V₂O₅). The internal rate of return (IRR) has been estimated at 50.8% and the net present value (NPV) at $338.3m, with a payback period of 1.72 years.

The average mine life is expected to be 13.5 years.

Nevada Vanadium president and CEO Ron Espell said: “The issuance of the Gibellini ROD is a significant milestone for the project. It would not have been possible without the exceptional professionalism of the Nevada Vanadium team, as well as members of the BLM, and other federal and state agencies.

“As one of the most advanced vanadium mine projects in the country, Gibellini represents exceptional optionality potential to provide a long-term domestic supply of high purity vanadium critical for establishing a strong domestic vanadium supply chain required to support dependent industries such as vanadium redox flow batteries, steel industries, and the super alloys needed for aerospace.

“Now, with the ROD in hand, we can concentrate on further exploring ways of reducing capital and operating costs in order to unlock the full value potential of this asset for all of our partners and stakeholders, in keeping with our deep commitment to community engagement and environmental stewardship.”

The Gibellini project will be powered by 6MW of solar and 10MW of vanadium flow battery, which will offer 100% of the project’s electricity requirements.

https://www.miningweekly.com/article/fi ... 2023-10-30Nevada BLM greenlights Gibellini vanadium project

30th October 2023

.......................

A 2021 preliminary economic assessment calculated capital expenditure of $147-million and operating cash costs of $4.7/lb of vanadium pentoxide.

https://www.agenceecofin.com/metaux/181 ... oprietaireAfrique du Sud : le projet de vanadium Mokopane change de propriétaire

Agence Ecofin 18 décembre 2023

En 2022, l’utilisation du vanadium dans le stockage d’énergie a connu une croissance en glissement annuel de 42 %. Alors que les analystes prédisent que cette nouvelle application soutiendra la demande du minéral, le producteur sud-africain Bushveld se donne les moyens d’en profiter.

En Afrique du Sud, Bushveld Minerals a conclu en fin de semaine dernière un accord définitif avec le fonds d’investissement Southern Point Resources pour lui céder ses 64 % de participations dans le prometteur projet de vanadium Mokopane. La société obtiendra en contrepartie un paiement de 3,7 millions de dollars ainsi qu’un droit de premier refus sur le minerai qui sera produit sur le projet, minerai qu’il compte racheter et traiter à son usine de Vanchem.

Cette opération, conditionnelle à plusieurs approbations, fait partie d’une série de transactions interdépendantes pour lesquelles des protocoles d’accord ont été annoncés en septembre dernier par les deux parties.

Au total, Southern Point Resources compte investir jusqu’à 77,5 millions de dollars pour acquérir des intérêts dans divers actifs de la compagnie Bushveld en Afrique du Sud, y compris 50 % de participations dans la filiale détenant l’usine de traitement de vanadium Vanchem. Le partenariat verra aussi le fonds assurer l’ensemble du marketing et des ventes de produits de vanadium provenant des usines de Bushveld.

« Southern Point est fier d’annoncer cette série de transactions collaboratives qui permettront à Bushveld de restructurer son bilan actuel et à toutes les parties prenantes de tirer des avantages significatifs d’un ensemble unique d’actifs sous-jacents avec un grand potentiel »,avait commenté le fonds d’investissement lors de l’annonce des protocoles d’accord.

Pour rappel, le projet Mokopane hébergerait, selon les estimations actuelles, l’une des plus grandes ressources mondiales de vanadium primaire. Les ressources et réserves de l’actif sont évaluées à 298 millions de tonnes, avec des teneurs variant de 1,6 % à plus de 2 % d’oxyde de vanadium.

https://www.miningweekly.com/article/st ... 2024-02-02Strategic Resources’ Finland project selected for EU vanadium/titanium study

2nd February 2024 By: Creamer Media Reporter

TSX-V-listed Strategic Resources’ Mustavaara project, in Finland, has been selected to be part of Avanti, a €5-million study on vanadium and titanium funded by the European Union (EU).

Currently, the EU relies on imports, primarily from China and Russia, for its vanadium and titanium needs.

Avantis aims to explore sustainable and decarbonised methods for co-extracting vanadium and titanium minerals from Europe’s low-grade vanadium-bearing titanomagnetic deposits.

The study project started in January, with the goal of assessing new extraction methods to produce two distinct pre-concentrates: ilmenite-rich, titanium pre-concentrate and ilmenite-free, vanadium pre-concentrate.

Strategic had previously completed a preliminary economic assessment in 2021 for the Mustavaara mine and concentrator, envisioning a smelter and hydrometallurgical plant in Raahe, separate from the mine site and concentrator.

The project development was based on 329 000 t of yearly pig iron and 4 577 t of yearly ferrovanadium (80) production over a 20-year mine life.