https://www.mining.com/american-battery ... ct-nevada/American Battery updates assessment of Tonopah Flats lithium project

Staff Writer | April 24, 2024

American Battery Technology (NASDAQ: ABAT) has updated the initial assessment for its Tonopah Flats lithium project near the town of Tonopah, Nevada, midway between Las Vegas and Reno. The company has been exploring the property since 2021.

The initial assessment was done in December 2023, and the current study is an update.

However, American Battery does not say the studies conform to National Instrument 43-101 definitions. Rather, the figures comply with the US S-K 1300, which the company says is “similar to a preliminary economic assessment”.

The Tonopah Flats claystone is one of the largest lithium resources in the US.

The measured and indicated resource is 3.16 million tonnes averaging 596 ppm lithium and containing 11.4 million tonnes of lithium hydroxide monohydrate (LHM). The inferred resource is 2.93 billion tonnes averaging 550 ppm lithium, containing 21.2 million tonnes LHM.

American Battery believes that over the 50-year mining period, about 540,000 tonnes of claystone will be treated annually.

The company plans to use its own dilute acid leaching lithium extraction process that has demonstrated recoveries lithium over 90%. It has also validated in-house lithium hydroxide manufacturing techniques.

Annual LHM production will be 30,000 tonnes of LHM.

Le lithium, le prix en baisse aprés la flambée.

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 90497

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

- Silenius

- Hydrogène

- Messages : 1730

- Inscription : 06 avr. 2007, 00:56

Re: Le lithium, le prix en baisse aprés la flambée.

Video de MrBidouille sur la mine d'Echassiere dans l'Allier

https://www.youtube.com/watch?v=Vhgih6ft6es

https://www.youtube.com/watch?v=Vhgih6ft6es

- energy_isere

- Modérateur

- Messages : 90497

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

merci pour la vidéo.

la mine souterraine de l 'Echassière donnerait 0.9 % de Li2O (dans un granit blanc)

les blocs de granit (2.1 million de tonnes par an) seront broyés finement et les parties Mica, Feldspath, et Quartz seront séparées. le Lithium est dans la parte mica.

le mica est récupéré par la technique connue de '' flottation''. Aprés séchage cela représentera 330 000 t sèches par an soit 16 % de la masse initiale du granit.

il y aura même un peu d'étain récupéré en co produit.

Le Feldspath sera récupéré car il intéresse certaines industries, le Quartz est ''stérile '' et servira de remblai à la mine souterraine et la mine à ciel ouvert de Kaolin.

il est prévu que les engins miniers souterrains soient électriques.

l'usine de conversion du mica sortira 34 000 t d' hydroxyde de Lithium par an. (de quoi faire 700 000 batteries de véhicules électriques chaque année)

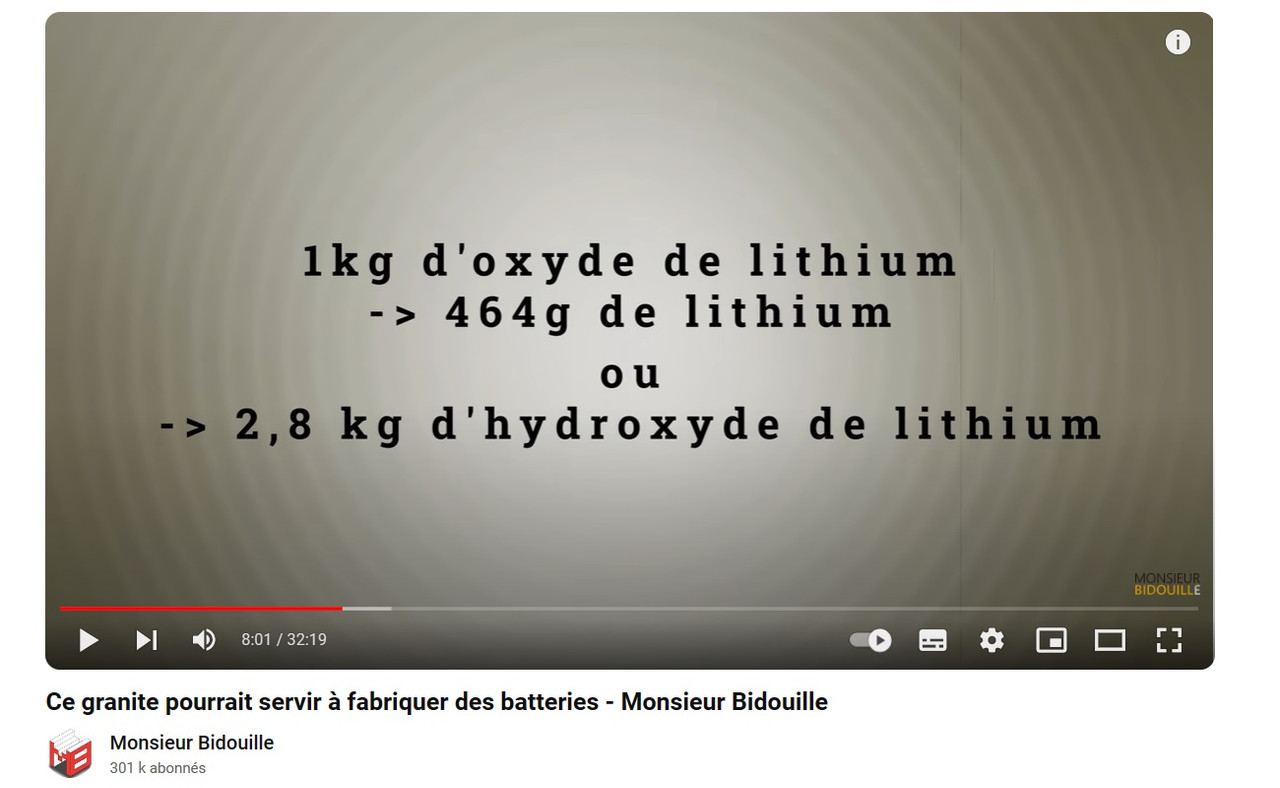

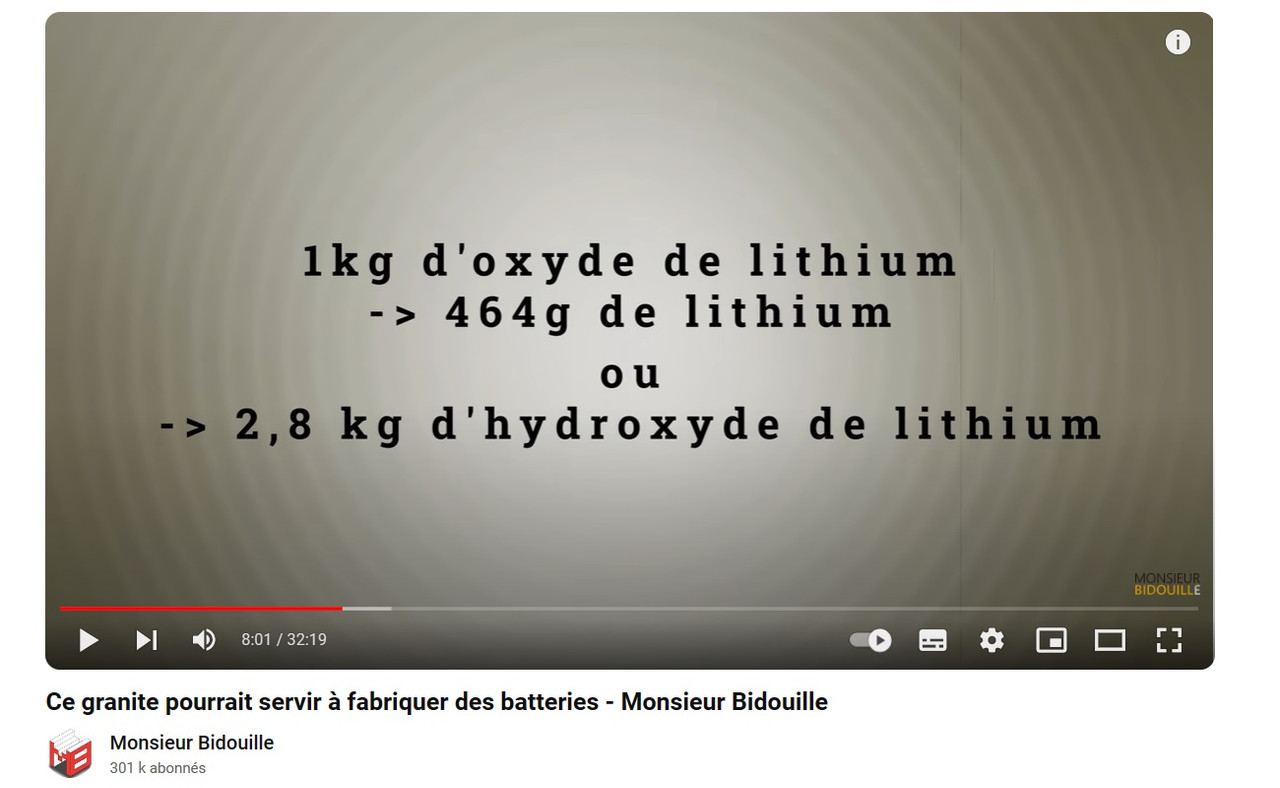

en passant, la conversion utile :

volet sur le recyclage en fin de vidéo.

la mine souterraine de l 'Echassière donnerait 0.9 % de Li2O (dans un granit blanc)

les blocs de granit (2.1 million de tonnes par an) seront broyés finement et les parties Mica, Feldspath, et Quartz seront séparées. le Lithium est dans la parte mica.

le mica est récupéré par la technique connue de '' flottation''. Aprés séchage cela représentera 330 000 t sèches par an soit 16 % de la masse initiale du granit.

il y aura même un peu d'étain récupéré en co produit.

Le Feldspath sera récupéré car il intéresse certaines industries, le Quartz est ''stérile '' et servira de remblai à la mine souterraine et la mine à ciel ouvert de Kaolin.

il est prévu que les engins miniers souterrains soient électriques.

l'usine de conversion du mica sortira 34 000 t d' hydroxyde de Lithium par an. (de quoi faire 700 000 batteries de véhicules électriques chaque année)

en passant, la conversion utile :

volet sur le recyclage en fin de vidéo.

- energy_isere

- Modérateur

- Messages : 90497

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

le projet de mine de Lithium de Imerys dans l' Allier :

https://emili.imerys.com/presentation-du-projet-emili

https://emili.imerys.com/presentation-du-projet-emili

mr Bidouille y a récupéré des informations qu' on retrouve dans sa vidéoLe projet EMILI comprend quatre composantes :

# Une mine souterraine, sous la carrière des Kaolins de Beauvoir sur le massif de la Bosse (site déjà exploité en surface) ;

# Une usine de concentration assurant la séparation des minéraux contenus dans le granite qui est la roche minéralisée en lithium. Cette usine, située également sur le site de Beauvoir, aurait une capacité annuelle de traitement d’environ 2 millions de tonnes de minerais ;

# Une plateforme de chargement ferroviaire qui serait située à «La Fontchambert», à proximité de Saint-Bonnet-de-Rochefort. Le concentré du minéral qu’on appelle mica y serait alors apporté par canalisations et filtré avant d’être chargé dans des trains ;

# Une usine de conversion, à «La Loue» (commune de Saint-Victor, dans l’agglomération de Montluçon), accessible par voie ferroviaire et ayant une capacité annuelle de traitement d’environ 330 000 tonnes de mica lithinifère (permettant de produire environ 34 000 tonnes d’hydroxyde de lithium par an).

Allant de l’extraction à la conversion sur un même périmètre géographique, ce choix de gestion en circuit court participe ainsi à une réduction de l’impact carbone du projet tout en soutenant le développement du territoire.

Par ailleurs, le groupe vise à destiner sa production à la filière européenne de production de batteries.

- energy_isere

- Modérateur

- Messages : 90497

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 26 oct 2023 http://www.oleocene.org/phpBB3/viewtopi ... 5#p2378955

https://www.nsenergybusiness.com/news/s ... h-equinor/Standard Lithium enters $160m lithium partnership with Equinor

By NS Energy Staff Writer 09 May 2024

Under the terms of the agreement, Equinor will invest up to $160m in exchange for a 45% stake in Standard Lithium’s two lithium projects in southwest Arkansas and east Texas

Aerial footage of the Southwest Arkansas project. (Credit: Standard Lithium)

Canadian mining company Standard Lithium has teamed up with Norwegian oil and gas company Equinor to advance the development of its sustainable lithium projects in the US.

Under the terms of the agreement, Equinor will invest up to $160m in exchange for a 45% stake in Standard Lithium’s two lithium projects in southwest Arkansas and east Texas.

The investment includes a $30m cash payment in compensation for the previous costs.

Equinor will fund a $60m work program at the acquired assets, comprising $33m Standard Lithium’s share and $27m its share.

The Norwegian company will also make milestone payments of up to $70m to Standard Lithium upon both parties reaching a final investment decision (FID).

Standard Lithium will own the remaining 55% of the two lithium projects and retain the operatorship, and Equinor will support the operator with core competencies.

............................................

- energy_isere

- Modérateur

- Messages : 90497

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 14 nov 2024 http://www.oleocene.org/phpBB3/viewtopi ... 0#p2380160

https://www.mining-technology.com/news/ ... &cf-closedEramine Sudamerica to open lithium carbonate plant in Argentina

The plant is expected to produce 3,000 tonnes (t) of lithium carbonate this year, with plans to increase production to 24,000t by 2025.

May 7, 2024

Eramine Sudamerica is gearing up to inaugurate its first lithium carbonate plant in the northern Argentine province of Salta by July 2024.

This strategic move is set to establish the company as Argentina’s fourth producer of lithium, a critical component in battery technology, according to a Reuters report posted on the Economic Times.

The facility is located on the Centenario Ratones salt flat approximately 1,400km north-west of Buenos Aires at an altitude of 4,000m.

Eramine Sudamerica’s sustainability director Constanza Cintioni told the news agency that the plant is expected to produce around 3,000t of lithium carbonate this year, with plans to increase production to approximately 24,000t by 2025.

Cintioni explained that the output from the plant will be exported and have an expected useful lifespan of four decades.

She also disclosed an estimated total investment of $800m (704.57bn pesos) for the project, with intentions to establish a second similar facility in the same basin at a future date.

The Eramine Sudamerica plant will employ a direct extraction method for lithium, differing from other projects that typically use brine evaporation from pools.

This innovative approach comes at a time when lithium, essential for mobile phone and EV batteries, has experienced a price surge following a plunge in 2023, largely due to a slowdown in EV sales in China, according to the news agency.

The establishment of the lithium carbonate plant in Salta is a key development under the administration of President Javier Milei, who is focused on enhancing foreign reserves through exports in mining, energy and grains to combat the nation’s severe economic crisis and high inflation rates.

This new plant is the first lithium carbonate facility in Salta and adds to the three existing lithium production facilities in Argentina.

Industry sources have estimated that the country’s lithium exports saw a 20% increase last year.

- energy_isere

- Modérateur

- Messages : 90497

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 4 février 2024 http://www.oleocene.org/phpBB3/viewtopi ... 0#p2384810

https://www.mining-technology.com/news/ ... s/?cf-viewSigma Lithium boosts mineral reserves at Brazil’s Grota do Cirilo

The expansion equates to an additional 22.2 million tonnes (mt) and raises the consolidated reserve balance to 77mt.

May 9, 2024

Sigma Lithium has announced a 40% increase in proven and probable mineral reserves at its Grota do Cirilo lithium project in Vale do Jequitinhonha, in the Brazilian state of Minas Gerais.

This expansion equates to an additional 22.2mt, raising the consolidated reserve balance to 77mt at 1.40% lithium oxide (Li2O), up from 54.8mt at 1.44% Li2O.

The reserve increase is concentrated within the combined phases three and four mines, which will extend the lifespan of Sigma Lithium’s integrated mining and beneficiation operations to an estimated 25 years.

This includes two processing lines with a combined capacity of 520,000t per annum, of which the second line, currently under construction, will contribute 250,000t.

The company noted that the enhanced mineral reserve balance paves the way for sustained, low-cost lithium production growth at the Grota do Cirilo operations.

..............................

- energy_isere

- Modérateur

- Messages : 90497

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Le lithium, le prix en baisse aprés la flambée.

suite de ce post du 12 nov 2023 http://www.oleocene.org/phpBB3/viewtopi ... 0#p2380040

pour le projet de mine de Lithium de Barroso au Portugal une des clé est l'acquisition du terrain, pas facile pour le minier.

pour le projet de mine de Lithium de Barroso au Portugal une des clé est l'acquisition du terrain, pas facile pour le minier.

https://www.mining.com/web/savannah-cou ... m-project/Savannah could request compulsory land acquisitions for Portuguese lithium project

Reuters | May 9, 2024

London-based Savannah Resources will if necessary ask Portugal’s government to authorize compulsory land acquisitions for its planned lithium mines in the country’s north, CEO Emanuel Proenca said, adding that it prefers “friendly deals”.

The company requires around 840 hectares for its four-mine project in the Barroso region, but according to data from September 2023, it had acquired or was in process of acquiring just 93 hectares.

Savannah has faced strong opposition to the project from local residents and environmentalists, via protests, legal challenges or simply by refusals to sell land. Private owners hold around 24% of the land needed, while 75% is traditional “baldios”, or common land.

Proenca told an investor presentation on Wednesday that Savannah has so far acquired over 100 plots, though it is not clear how many hectares that represents.

The CEO said Portuguese legislation allowed for other solutions in terms of “land access and compulsory land acquisition”.

“We are obviously aware of those solutions and there will eventually be a moment in which we will resort to them… that moment hasn’t come yet so we continue to privilege friendly acquisitions and friendly deals,” Proenca said, adding that the relationship with the local community was improving.

The company wants to start production in 2026, extracting enough lithium each year for around half a million batteries used in electric vehicles.

The government could authorize a compulsory purchase in the public interest.

With 60,000 metric tons of known reserves, Portugal is already Europe’s biggest producer of lithium for the ceramics industry. The region of Barroso – a Food and Agriculture Organization heritage site – contains one of its richest deposits of lithium.

Proenca said the land the company needed was mostly “industrial pine tree forest”, adding: “We are not affecting a single house, we do not have to relocate a single person.”

In February, prosecutors asked a judge to annul an environmental permit for the project, alleging legal infringements and citing risks that the mine could endanger the heritage site.

Savannah at the time cited advice from its lawyers “that the lawsuit is without foundation” and expected no impact on its activities.