https://www.boursorama.com/actualite-ec ... 9a9c13de6dExplosion dans une usine de nickel en Indonésie: 13 morts, 38 blessés

AFP•24/12/2023

Une explosion survenue dimanche a fait au moins 13 morts et 38 blessés dans une usine de traitement de nickel chinoise implantée sur l'île de Sulawesi, dans l'est de Indonésie, a annoncé un responsable local.

L'accident s'est produit vers 05H30 (21H30 GMT samedi) dans une usine de la compagnie Indonesia Tsingshan Stainless Steel (ITSS) dans le parc industriel de Morowali, a indiqué Dedy Kurniawan, porte-parole de cette zone industrielle.

Initialement établi à 12, le bilan des morts s'est alourdi à 13, huit Indonésiens et cinq Chinois, après le décès d'un des blessés. Le nombre de blessés à des degrés divers s'élève à 38, selon la même source.

L'île de Sulawesi est un grand centre de production de nickel, un métal de base utilisé notamment dans les batteries des voitures électriques et pour la fabrication de l'acier inoxydable. La Chine a fortement investi dans des usines sur place mais les conditions de travail et de sécurité y sont souvent décriées.

Selon les premiers éléments de l'enquête, l'explosion a eu lieu pendant des travaux de réparation d'un haut-fourneau. Un liquide inflammable s'est embrasé, et l'incendie s'est propagé à des réservoirs d'oxygène qui ont explosé, a expliqué le porte-parole. L'incendie a été éteint dans la matinée de dimanche.

Un salarié du site a témoigné auprès de l'AFP de la gravité des lésions des victimes. "Leurs visages étaient brûlés, leurs vêtements étaient complètement brûlés", a-t-il dit sous couvert d'anonymat.

Un responsable du parc industriel, Rachmansyah Ismail, a indiqué à la chaîne Kompas TV que 25 blessés, en majorité des Indonésiens, avaient été hospitalisés, dont 17 avec des blessures graves.

ITSS est une filiale du numéro un mondial du nickel, le groupe chinoisTsingshan Holding Group, qui contrôle également le parc de Morowali.

En janvier, deux travailleurs, dont un citoyen chinois, avaient été tués dans une usine de fusion de nickel située dans le même complexe industriel pendant une émeute déclenchée à cause des conditions salariales et de la sécurité au travail. En juin, un accident survenu dans cette usine avait fait un mort et six blessés.

Nickel

Modérateurs : Rod, Modérateurs

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

suite de ce post du 3 dec 2023 http://www.oleocene.org/phpBB3/viewtopi ... 3#p2381103

Samsung investi dans le projet de Nickel Canadien Crawford et s'assure 10% de sa future production de Nickel et Cobalt :

Samsung investi dans le projet de Nickel Canadien Crawford et s'assure 10% de sa future production de Nickel et Cobalt :

https://www.mining.com/samsung-sdi-acqu ... d-project/Samsung SDI invests in Canada Nickel, has right to buy 10% of Crawford project

Staff Writer | January 12, 2024 |

South Korean battery manufacturer Samsung SDI has become the latest company to invest in Canada Nickel Company (TSXV: CNC), which is developing the Crawford nickel sulphide project in the Timmins-Cochrane mining camp of Ontario.

Pursuant to a subscription agreement entered Friday, Samsung intends to purchase $18.5 million worth of Canada Nickel’s common shares at C$1.57 per share. Upon closing, Samsung will own approximately 8.7% of the company’s outstanding share capital.

The battery maker will also be granted the right to purchase a 10% equity interest in the Crawford project for $100.5 million, exercisable upon a final construction decision. This would give Samsung the right to 10% of the nickel-cobalt production from the Crawford project over the life of mine, and the right to an additional 20% of production for 15 years, extendable by mutual agreement.

Shares of Canada Nickel Company gained 3.1% to C$1.63 apiece by 12:30 p.m. EDT in Toronto Friday on the Samsung investment. Its market capitalization rose to C$231.6 million ($172.7 million) accordingly.

Crawford is currently host to the world’s second-largest nickel resource, totalling 2.46 billion tonnes at 0.24% nickel for 13.3 billion lb. of contained nickel, according to a feasibility study issued in October, which pegged the project’s after-tax net present value (8% discount) at $2.6 billion and internal rate of return at 18.3%.

The proposed operation will consist of two open pits complemented by an on-site mill, to be completed in two phases to allow for throughput ramp-up, the study showed. Total capital cost for the two phases is estimated at $3.5 billion.

Over a 41-year project life, total metal production is calculated at 3.54 billion lb. of nickel, 52.9 million lb. of cobalt, 490,000 oz. of palladium and platinum, 58 million tonnes of iron, and 6.2 million lb. of chromium. First production is targeted for 2027.

.......................

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

Situation de surplus sur le marché du Nickel.

https://www.mining.com/web/surging-exch ... on-nickel/Surging exchange stocks pile the pressure on nickel

Reuters | January 18, 2024 |

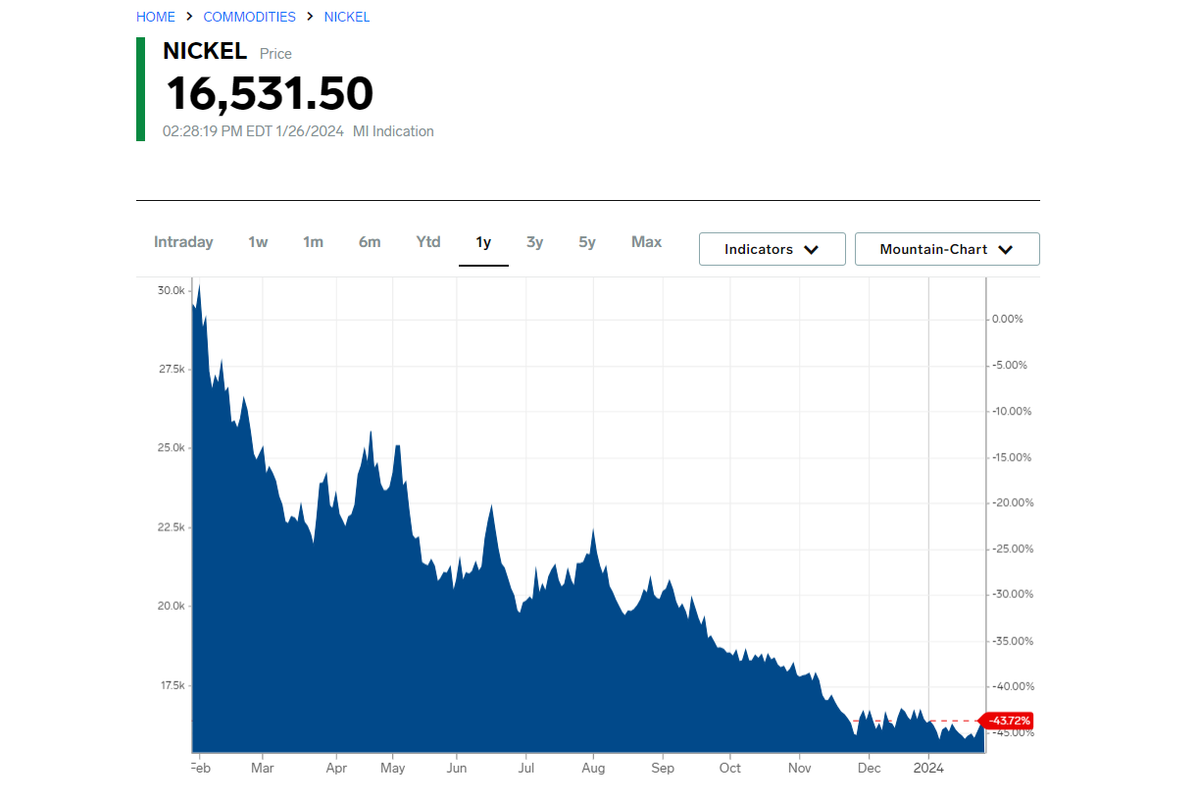

Nickel was the worst performer among the London Metal Exchange’s (LME) base metals last year by some margin as the market priced in a wave of new Indonesian supply.

Indonesia’s mined production rose by 29.2% year on year in the first 10 months of 2023, according to the International Nickel Study Group. Nickel demand is rising fast thanks to its use in electric vehicle batteries but nowhere near the pace of supply growth.

Until recently the growing supply surplus was confined to intermediate products such as ferronickel and matte rather than the high-purity refined metal that trades on the LME and the Shanghai Futures Exchange (ShFE).

That is changing as stocks rise on both exchanges, narrowing the pricing gap between refined metal and other forms of nickel.

LME three-month nickel , currently trading at $16,050 per metric ton, is now eating into the cost curve and hard-pressed producers could face more margin pain.

Stocks surge

.................................

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

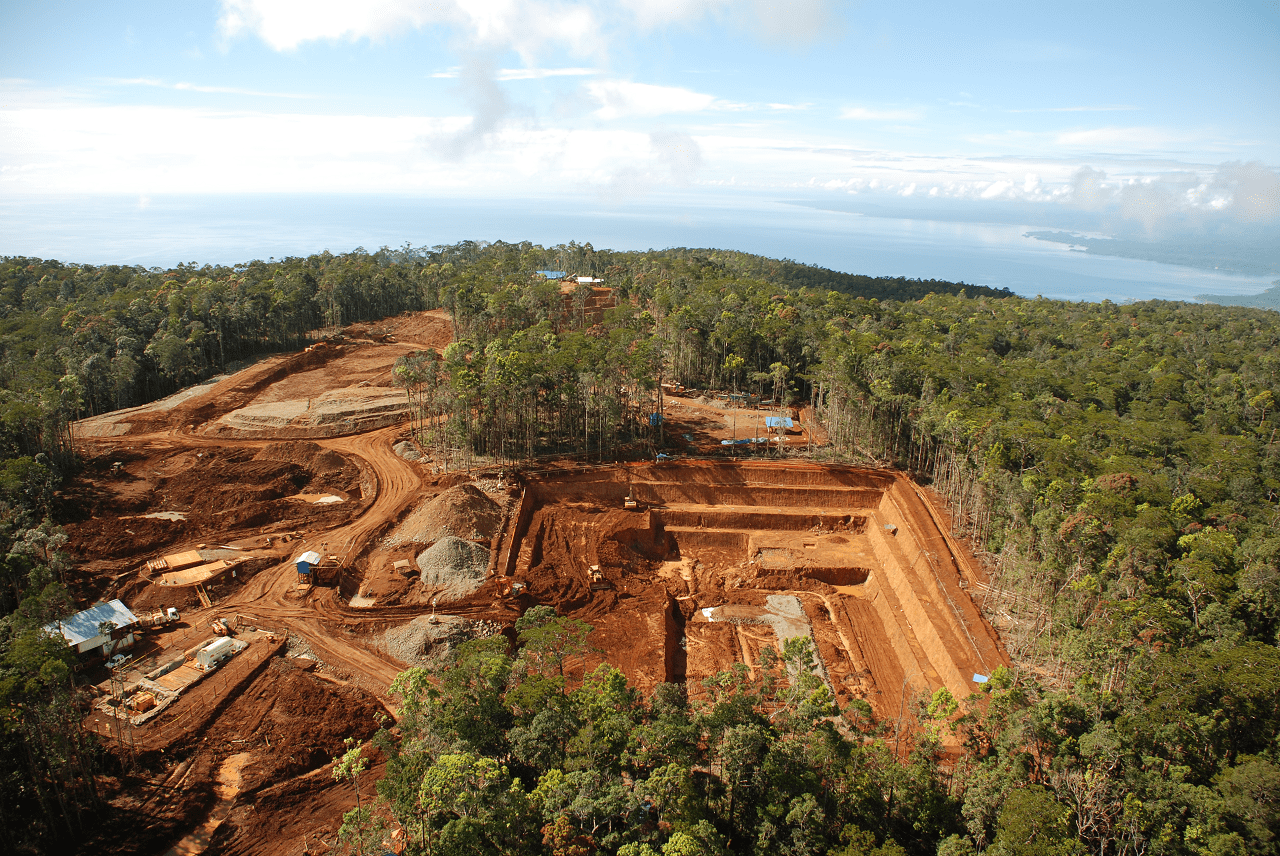

L'industrie du Nickel en Indonésie responsable de déforestation de forêt tropicale :

https://www.mining.com/web/foreign-back ... on-report/Foreign-backed nickel hub in Indonesia causing mass deforestation – report

Reuters | January 17, 2024

Weda Bay nickel operations. Credit: Eramet

Mining activity at a nickel industrial park linked to mainly Chinese companies has contributed to mass deforestation in Indonesia, a non-governmental group said in a report.

The report of ecological damage in the nickel industry comes as Indonesia, home to the world’s largest nickel ore reserves, seeks to extract more value from the mineral by attracting investment into its processing and in the manufacturing of electric vehicle batteries.

The country has also set a production target of some 600,000 electric vehicles (EV) by 2030 – more than 100 times the number of EVs sold in Indonesia in the first half of 2023.

In the report released on Wednesday, US-based Climate Rights International (CRI) documented activity at the Indonesia Weda Bay Industrial Park (IWIP), one of the country’s largest nickel processing hubs, whose investors include China’s Tsingshan Holding Group and France’s Eramet.

The operator of the park, on Halmahera island in the Maluku region, is a joint venture between China’s Zhejiang Huayou Cobalt, Zhenshi Holding Group and Tsingshan.

IWIP, Tsingshan, Eramet, Huayou, Zhenshi and the forestry ministry did not respond to Reuters‘ requests for comment.

CRI said companies, which had permits, have cut down more than 5,300 hectares of tropical forest within the park’s concession since 2018, citing geospatial analysis of satellite imagery conducted by the group and researchers at the University of California, Berkeley, in the United States.

That is roughly the size of over 6,000 soccer pitches.

Experts have raised concerns the nickel industry could worsen deforestation in Indonesia, a resource-rich country that is also home to massive rainforests.

After years of rampant deforestation, Indonesia has had success in slowing the rate at which forests are cleared for plantations and other industrial activity.

From 2020 through 2022, Indonesia reduced its average primary forest loss by 64% compared with 2015-2017, showed data from research group World Resources Institute.

CRI also estimated carbon dioxide emissions from deforestation were “roughly equivalent to the annual emissions of 450,000 cars.”

President Joko Widodo told Reuters last year Indonesia would increase scrutiny of miners and order companies to manage nurseries and reforest depleted mines.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

https://www.mining.com/web/lithium-vent ... e-project/Lithium venture in Chile in talks with EV firms to invest in mine project

Bloomberg News | January 17, 2024

A joint venture valued at $1.5 billion to $2 billion that wants to become Chile’s third lithium producer is in talks with investors to bankroll its project.

Simco Lithium, owned by a Singaporean investment fund and a Chilean business group, is exploring the sale of a non-controlling stake, said Sebastian Yang, a board member representing the Simbalik fund. While the around $600 million project is too small to appeal to major mining firms, there is interest from battery and electric-vehicle makers.

“We’ve been in talks with different groups along the value chain,” he said in an interview.

Users of lithium, a key component in EV batteries, have been investing in exploration and extraction projects around the world as they look to lock in future supplies. While prices of the metal have plunged in the past year or so as new mines come on stream, the longer term outlook is supported by growing demand in the transition away from fossil fuels.

Simco, whose other owner is Chile’s Errazuriz group, is working with indigenous groups and finalizing a feasibility study for the project on the Maricunga salt flat. It hopes to begin construction this year using a direct extraction method developed by Utah’s IBC Advanced Technologies Inc. that’s been working well in a pilot plant, Yang said. It’s signed offtake accords with Japan’s Panasonic Holdings Corp. and Chori Co. Ltd.

Chile’s only two producers today, SQM and Albemarle Corp., operate with strict government output quotas. But Simco holds concessions that predate Chile’s 1982 code, meaning it can develop and operate the project independently, according to Yang. That’s despite the government introducing a new model in which private firms have to partner with state enterprises such as Codelco.

Salar Blanco, another Maricunga project with pre-code concessions, is being acquired by Codelco via the state company’s purchase of Lithium Power International Ltd. That deal would simplify Codelco’s efforts to develop lithium in the salt flat.

Simco plans to press ahead as an independent project and would seek arbitration if authorities rescinded its permits, Yang said. Still, the venture has proposed collaborating with Codelco on Maricunga, such as offering to process the state company’s brine or helping it set up its own plants. “The door is always open,” Yang said.

Simbalik may look to exit the venture once the mine is up and running, he said.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

suite de ce post du 10 sept 2023 http://www.oleocene.org/phpBB3/viewtopi ... 8#p2376688

https://www.mining.com/sumitomo-partici ... 9-9-stake/Sumitomo participates in FPX Nickel financing to gain 9.9% stake

Staff Writer | January 17, 2024

Sumitomo Metal Mining Canada is investing about C$14.5 million to gain a 9.9% interest in FPX Nickel (TSXV: FPX). Sumitomo will participate in a private placement, purchasing approximately 30.1 million FPX shares at a price of C$0.48 per share.

“This strategic investment by Sumitomo Metal Mining represents another significant technical validation of FPX’s Baptiste nickel project and underscores our view that Baptiste is a class-leading asset,” said Martin Turenne, FPX’s president and CEO.

“SMM is one of the world’s largest nickel producers, with peer-leading expertise in mining, processing and refining products in the stainless steel and electric vehicle battery supply chains. FPX is pleased to be one of SMM’s preferred partners as they look to expand their nickel production profile and diversify their supply chain to allied partners in North America.”

FPX owns 100% of the Baptiste nickel project in the Decar nickel district of British Columbia, northwest of Fort St. James. This is a large greenfield discovery of naturally occurring awaruite (Ni3Fe). Similar mineralization has been identified in several target areas, but the Baptiste deposit is the most advanced, having reached the prefeasibility phase.

The prefeasibility study completed last year gave the project an after-tax net present value with an 8% discount of C$2.75 billion. The after-tax internal rate of return is 18.6% using a nickel price of $8.75/lb.

FPX intends to use the proceeds of this private placement for exploration and development activities at the project, continuance of ongoing environmental baseline activities, feasibility study readiness activities, and general corporate and administrative purposes.

The private placement is expected to close on Jan. 22, 2024, subject to certain customary conditions.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

Nouveau projet de Nickel au Brésil :

https://www.mining-technology.com/news/ ... &cf-closedCentaurus gets technical approval for Brazil nickel project

The approval is a crucial step towards formal issuance of the mining lease, pending an Installation Licence (LI) from the Environmental Agency.

January 19, 2024

Centaurus Metals has received technical approval for its Mining Lease Application – PAE for its Jaguar Nickel Sulphide Project from the Brazilian National Mining Agency (ANM).

The approval is a crucial step towards the formal issuance of the mining lease, pending the LI from the Environmental Agency.

ANM’s endorsement of the Plan of Economic Assessment (PAE) confirms that Centaurus Metals has met all technical requirements for the mining lease and can implement the project.

The next and final stage before the mining lease can be granted is the issuance of the LI by the Pará State Environmental Agency (SEMAS).

Additionally, the project also has an Environmental Impact Assessment (EIA) and Preliminary Licence (LP) in place from the Pará State Environmental Committee.

The formal issue and gazettal of the LP are now awaiting the completion of internal processes at the environmental agency.

Centaurus Metals has submitted all necessary documentation to SEMAS for this purpose.

The company’s development timetable remains on track, with this approval coming just before the completion of the Definitive Feasibility Study.

Approved PAE and LP are based on a projected production rate of 20,000 tonnes per annum of nickel-in-sulphate at the Jaguar site.

The EIA, which was finalised in early January 2023 following the November 2022 JORC Mineral Resource Estimate, incorporates extensive environmental and social data collected over 18 months.

Upon approval of the LI, Centaurus Metals will possess all necessary environmental clearances to commence construction at the Jaguar Nickel Sulphide Project site and secure the formal mining lease.

The company expects the LI to be secured in the second half of 2024.

Centaurus Metals managing director Darren Gordon said: “To have secured approval of the LP just on 12 months from lodging the final EIA is a testament not just to the hard work undertaken by our Brazilian approvals team but also to the strength of the Brazilian approvals system – which supports the development of mining projects that have been extensively studied from an environmental perspective and have strong environmental management systems and controls either in place or planned.”

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

conséquence de la chute des cours du Nickel :

https://www.mining.com/web/australian-t ... ces-crash/Australian tycoon Forrest shuts nickel mines after prices crash

Bloomberg News | January 21, 2024 |

Wyloo Metals Pty Ltd., the private nickel producer owned by billionaire Andrew Forrest, is shutting down its Western Australian mines due to a sharp slump in prices for the key transition metal.

The mines near Kambalda will go into care and maintenance from May 31, the company said in a statement on Monday. Wyloo, which bought the mines only six months ago, informed BHP Group Ltd. that it won’t be able to fulfill a nickel off-take agreement that’s due to expire at the end of 2025, a spokesperson added.

Prices for nickel — used to make stainless steel and EV batteries — have slumped in the past year, mainly driven by a flood of cheap supply from Indonesia that’s threatening to disrupt the industry. Earlier this month, First Quantum Minerals Ltd. said it will halt mining at its nickel and cobalt operation in Australia and cut a third of the workforce in response to weaker metal prices and higher costs.

The closure of Wyloo’s Kambalda mines comes after BHP, the world’s biggest miner, last week warned it could be forced to write down the value of its nickel to mitigate the crash in prices.

Wyloo, which owns assets in Canada and Australia, last year also entered into a joint venture agreement with with IGO Ltd. to produce battery-ready materials at a plant near Perth. Despite the shutdown of the mines, it’s studying developing its own nickel concentrator in the Kambalda region, Wyloo said in the statement.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

Nouveau prospect de Nickel : le projet Wine dans le Manitoba, Canada.

https://www.northernminer.com/news/nica ... 003863409/NiCAN shares soar on high-grade nickel results at Wine project in Manitoba

POSTED BY: BLAIR MCBRIDE JANUARY 31, 2024

Shares in Manitoba-focused NiCAN (TSXV: NICN) surged 266.6% Wednesday on new assay results showing its longest zone of nickel-equivalent mineralization to date at its Wine property in west-central Manitoba.

Diamond drill hole Wine 23-29 cut 31.5 metres averaging 1.9% copper and 1.92% nickel (2.31% nickel-equivalent) from 36.5 metres depth, the company reported. The hole included 9.6 metres grading 2.2% copper and 1.56% nickel from 4.2 metres, in what NiCAN calls the Upper zone. Hole wine 22-6 returned 9.8 metres of 2.09% copper and 1.23% nickel from 7.4 metres in that zone.

The results were from NiCAN’s third phase of exploration at Wine, completed last year. ......................

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

Petite baisse de 5% de la production de Nickel en 2023 pour le russe Nornickel.

https://www.mining.com/web/nornickel-fo ... this-year/Nornickel forecasts further nickel, palladium output drop this year

Reuters | January 29, 2024

Russian metals producer Nornickel on Monday said it expected a further decline in nickel and palladium output this year, hit by adverse geopolitical risks and postponed furnace repairs, following on from a drop in production in 2023.

CEO Vladimir Potanin said last year that sanctions had constrained Nornickel’s development, though Western governments have refrained from targeting Nornickel directly in response to the conflict in Ukraine.

Nornickel, the world’s largest palladium producer and a major producer of refined nickel, said its nickel production fell 5% year on year to 209,000 metric tons in 2023. This year, the company expects nickel output at 184,000-194,000 tons.

Palladium output dropped by 4% in 2023 to 2.692 million troy ounces, Nornickel said. This year, palladium output is seen at 2.296-2.451 million troy ounces.

The company had expected output for both metals to drop in 2023, but palladium output came in above forecast.

Nornickel’s senior vice-president and operational director Sergey Stepanov said output of all key metals, except platinum, slightly decreased in 2023 due to lower mined rich and cuprous ore volumes as the company transitions gradually to new mining equipment.

“After testing and gradual roll-out of equipment from new suppliers, our mines recovered to the scheduled mining volumes in the fourth quarter,” said Stepanov.

“In 2024, we expect that risks related to an adverse geopolitical situation will continue to impact our operations,” he said. “Furthermore, this year we are planning capital repairs of the flash smelting furnace #2 at Nadezhda Metallurgical Plant.”

Repairing the furnace, which has been delayed for two years due to issues with the supply of equipment, is now expected in mid-2024, Stepanov said. Nornickel did not say whether it has found equipment suppliers.

Platinum output rose 2% in 2023 to 664,000 ounces and is seen falling to 567,000-605,000 ounces in 2024, Nornickel said.

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :

Re: Nickel

https://www.mining.com/web/from-green-h ... -imploded/From green hype to bailouts, the nickel industry has imploded

Bloomberg News | February 3, 2024

Just 18 months ago, the world’s biggest mining company was in a nickel frenzy. BHP Group, to much fanfare, had struck a deal with Tesla Inc. to supply it with the crucial ingredient for electric vehicles. It was about to go toe-to-toe with Australian billionaire Andrew Forrest for control of one of the globe’s most prospective mines.

For BHP, nickel offered a bright spot. Its management had earmarked the material as a key pillar of growth, a future-facing commodity that would help offset its exit from fossil fuels and let it tap into new demand driven by the world’s race to decarbonize.

Yet things have quickly soured for BHP and other miners. The nickel market has been thrown into chaos after a flood of new supplies from Indonesia — the result of huge Chinese investment and major technological breakthroughs. Mines across the world are at risk of closing, others are asking for state bailouts or going bust. BHP, for one, is now weighing up the future of its flagship Nickel West mine in Australia.

Until recently, many of the industry’s biggest names couldn’t have been more bullish about the prospects for nickel. The once-boring metal, traditionally used to make steel stainless, is a crucial ingredient for electric vehicle batteries. A supply shortage stretching for years to come was forecast and mining companies jumped at a great opportunity to burnish their green credentials.

Traditionally, nickel has been split into two categories: low grade for making stainless steel and high grade for batteries. A huge Indonesian expansion of low-grade production led to a surplus, but processing innovations have allowed that glut to be refined into a high-quality product that’s hitting the battery market.

As a result, prices for the metal have crashed over 40% from a year ago, adding to hurdles in a market that is also wobbling from weak demand and persistent concerns about China’s economy. Macquarie analysts estimate that more than 60% of the global industry is losing money at current prices.

The scale of the collapse has left some in the industry questioning if there’s a future for most nickel mines outside of Indonesia. It’s also adding to concerns among US and European policymakers about China’s control over key commodities, with its companies leading much of Indonesia’s production.

“After watching the tide go out on the nickel world for over a year – with the halving of its metal price – we’ve got some high-cost assets exposed now,” said Tom Price, head of commodities strategy at Liberum Capital Ltd. He added that mines in Western Australia and the French territory of New Caledonia are likely to be the most vulnerable.

In New Caledonia — the South Pacific island chain that was once seen as the future of nickel production — the French government has been forced to step in to keep mines and plants operating that are essential to the territory’s economy. Officials have been meeting with key shareholders of three processing plants to hammer out a rescue deal, with no breakthrough so far.

The situation has been equally bleak in Australia.

In addition to BHP’s review of nickel assets there, Panoramic Resources Ltd. is suspending a key mine after entering voluntary administration late last year, when it failed to find a buyer or partner. An IGO Ltd. site will be shuttered, as will some operated by tycoon Andrew Forrest’s Wyloo Metals Pty Ltd. and First Quantum Minerals Ltd.

Producers in Western Australia are also turning to officials for help. At a crisis meeting at the end of last month, miners asked the federal government to provide tax credits for downstream processing.

But even with production pullbacks starting to bite, they’re unlikely to provide imminent support to nickel prices, according to Allan Ray Restauro, an analyst at BloombergNEF. He said, “The flood of supply from Indonesia is projected to continue to exert downward pressure on prices in 2024.”

That’s because Indonesian production — which already accounts for half of global supply — may prove more resistant to output cuts. The Southeast Asian nation has emerged as a global nickel hub after billions of dollars of investment in efficient plants that benefit from inexpensive labor, cheap power and readily available raw materials.

Still, the country’s rapid expansion has drawn criticism. Much of its production comes from coal-powered energy, giving it higher emissions per ton than rival producers, and its rapid expansion is eroding rainforests.

Producers such as BHP have instead trumpeted that buyers paying a premium for so-called green nickel would help lift prices. So far, however, there has been little evidence of that.

The company conceded late last year that automakers remain happy to buy Indonesian nickel, suggesting there will be little relief for miners elsewhere any time soon.

‘What can stop these mine and project closures? A sustained lift in nickel prices, obviously,” said Liberum’s Price. “Typically, only a nickel demand recovery can achieve that.”

- GillesH38

- Hydrogène

- Messages : 27376

- Inscription : 10 sept. 2005, 17:07

- Localisation : Berceau de la Houille Blanche !

- Contact :

Re: Nickel

ah ben zut, c'est pas le prix du pétrole qui s'effondre à cause d'un pic demande, c'est celui du lithium et du nickel...

Zan, zendegi, azadi. Il parait que " je propage la haine du Hamas".

- mobar

- Hydrogène

- Messages : 18223

- Inscription : 02 mai 2006, 12:10

- Localisation : PR des Vosges du Nord

Re: Nickel

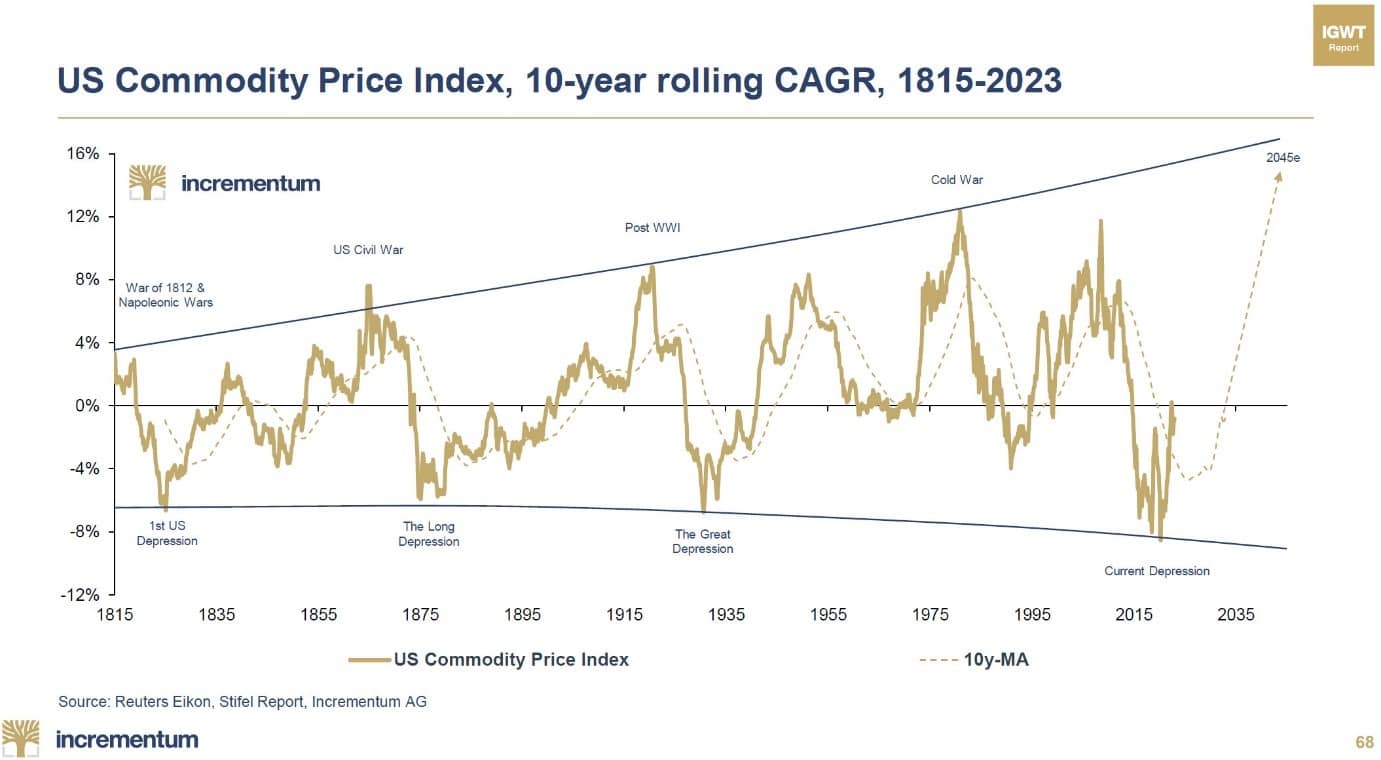

Les prix des matières premières font le yoyo depuis toujours et les cycles de hausse et de baisse durent parfois des décennies

La demande elle même est soumise à de multiples facteurs et suit des trajectoires imprévisibles ... que personne n'est capable d'anticiper au delà de quelques mois

Faut regarder tout ça de loin sans y attacher d'importance!

https://youtu.be/0pK01iKwb1U

« Ne doutez jamais qu'un petit groupe de personnes bien informées et impliquées puisse changer le monde, en fait, ce n'est jamais que comme cela que le monde a changé »

« Ne doutez jamais qu'un petit groupe de personnes bien informées et impliquées puisse changer le monde, en fait, ce n'est jamais que comme cela que le monde a changé »

- energy_isere

- Modérateur

- Messages : 90172

- Inscription : 24 avr. 2005, 21:26

- Localisation : Les JO de 68, c'était la

- Contact :