L’Indonésie mise sur le nickel, malgré les ravages de son exploitation

RFI le : 14/11/2022 Par : Gabrielle Maréchaux

Elon Musk échangera avec les dirigeants du monde entier au G20 qui s’ouvre à Bali cette semaine, invité en tant que dirigeant de Tesla par l’Indonésie, le pays organisateur. Premier producteur de nickel au monde, l’Indonésie intéresse grandement Elon Musk. Et si dans l’archipel indonésien, beaucoup s’enthousiasment de la manne financière que représente cette matière première, d’autres s’inquiètent des ravages de son exploitation sur l’environnement.

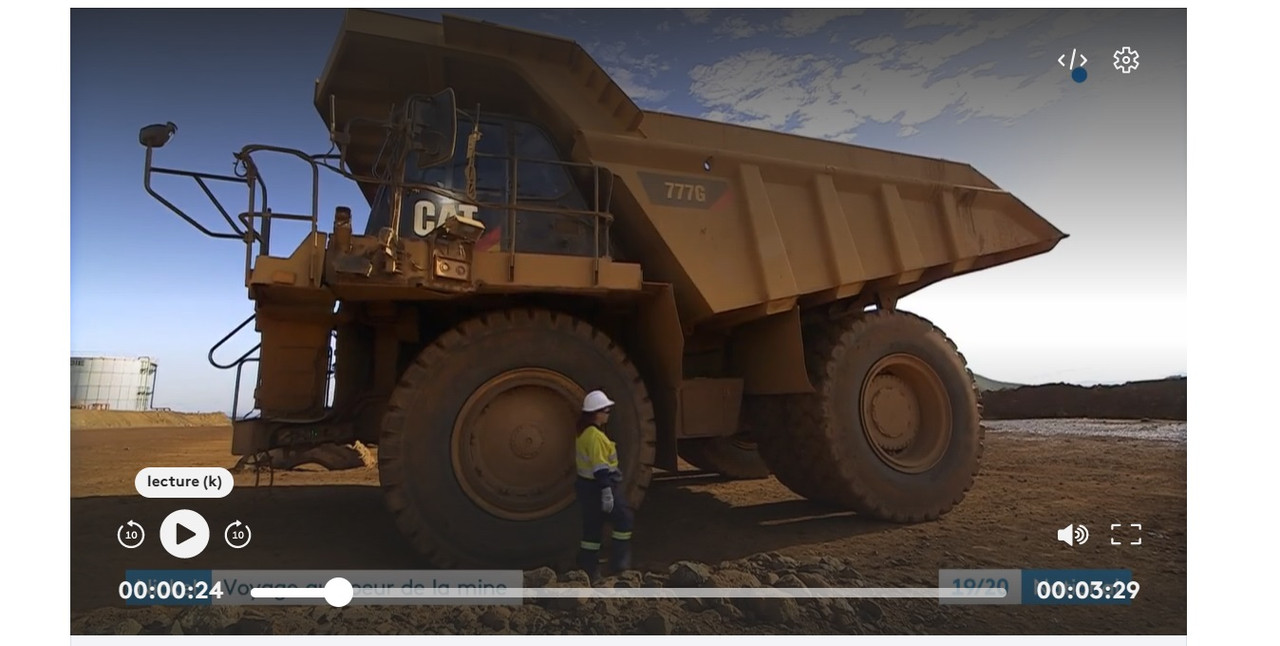

Vue aérienne de la fonderie de nickel de Virtue Dragon Nickel Industry (PT VDNI) à Konawe. L’utilisation de composants chimiques pour la transformation du nickel en batterie dont les déchets toxiques polluent les eaux sont sujets à fort peu de régulation. AFP - ANDRY DENISAH

Vue aérienne de la fonderie de nickel de Virtue Dragon Nickel Industry (PT VDNI) à Konawe. L’utilisation de composants chimiques pour la transformation du nickel en batterie dont les déchets toxiques polluent les eaux sont sujets à fort peu de régulation. AFP - ANDRY DENISAH

Pour bon nombre de consommateurs cherchant à réduire leur dépendance à l’essence, voiture électrique rime avec transition énergétique. En Indonésie, cela rime aussi avec inquiétudes écologiques. D’abord à cause de la déforestation : car c’est au total 673 000 hectares de forêts indonésiennes qui ont déjà été octroyés pour exploiter le nickel, un composant essentiel des batteries des voitures électriques.

Mais cette menace sur les écosystèmes ne semble toujours pas inquiéter. Les défenseurs de l’environnement indonésiens ont ainsi pu noter que si la déforestation générée par l’exploitation de l’huile de palme indonésienne est sévèrement condamnée par l’Union européenne, celle-ci semble moins déranger quand ce sont des pans entiers de forêts qui disparaissent pour extraire des minéraux essentiels aux voitures électriques, sur lesquelles l’UE mise beaucoup, et pour lesquelles ses besoins de nickels seraient multipliés par 31 entre 2020 et 2040. « Si l’UE veut être rigoureuse sur un produit de base comme [l’huile de palme], alors elle devrait faire de même pour un autre produit de base : [le nickel] » arguait à ça ce propos Yuyun Harmono, responsable de la campagne pour la justice climatique au Forum Indonésien pour l’Environnement en 2021.

Mais les dangers pour l’environnement ne s’arrêtent pas à la seule déforestation résultant de son extraction, car pour passer du nickel indonésien au composant pour batterie, il faut également le transformer, ce qui se fait en Indonésie en utilisant des composants chimiques dont les déchets toxiques sont sujets à fort peu de régulation.

Le « métal du diable »

Et si à l’échelle locale, sur l’île de Sulawesi par exemple, le nickel a donc mauvaise presse à cause notamment de la pollution des eaux qu’il génère à Jakarta, ce composant surnommé le métal du diable donne envie de rêver grand aux dirigeants. Et le pays, qui détient ¼ des réserves mondiales, a bien l’intention de tout faire pour maximiser cette manne de plus en plus prisée. Son ministre de l’Investissement a ainsi annoncé en août que Tesla avait signé des contrats d’approvisionnement en nickel d’une valeur de 5 milliards de dollars.

À écouter, Elon Musk, dirigeant de Tesla, une telle extraction massive du nickel pourrait être compatible avec un respect de l’environnement. En 2020, il promettait en effet des « contrats longs et géants » aux entreprises ou pays qui pourraient extraire du nickel de manière efficace et durable. Une chimère totale pour Rere Christianto, responsable des questions minières au Forum Indonésien pour l’environnement : « Toute exploitation de minéraux est de base une activité non durable, rappelle-t-il. Car il est impossible de recréer ces minéraux et de contrebalancer ainsi leur exploitation. Mais ce qui est possible, par contre, c’est de minimiser les risques environnementaux, en n’ouvrant pas plus de mines à nickel, et en concentrant les efforts sur le recyclage de ces batteries, pour réutiliser le nickel déjà extrait. »

Terres, eaux et ressources naturelles contrôlées par l’État

Mais cette façon de penser reste pour l’instant minoritaire en Indonésie, pays où l’exploitation à outrance des matières premières à des fins pécuniaires semblerait presque encouragée par la loi. Souvent surnommée « nationalisme des ressources » cette approche s’appuie en effet sur la Constitution du pays qui stipule dans son article 33 que les terres, les eaux et les ressources naturelles sont contrôlées par l’État et doivent être utilisées pour le plus grand bénéfice du peuple. Une formulation souvent interprétée de façon à justifier l’utilisation maximale des ressources naturelles du pays et à considérer celle-ci comme la meilleure façon d’atteindre le stade de pays développé.

Et afin de tirer son épingle du jeu au milieu de la grande effervescence mondiale suscitée par les véhicules électriques, le gouvernement indonésien a même annoncé en octobre qu’il songeait désormais à créer une structure semblable à celle de l’Opep pour représenter les intérêts des pays producteurs de minéraux nécessaires pour les batteries.