Chile loads its copper cannon with 13 projects for a bullish 2026

Cecilia Jamasmie | December 23, 2025

Thirteen Chilean copper projects worth $14.8 billion are expected to hit key milestones in 2026 as prices rise on fears of a global supply squeeze.

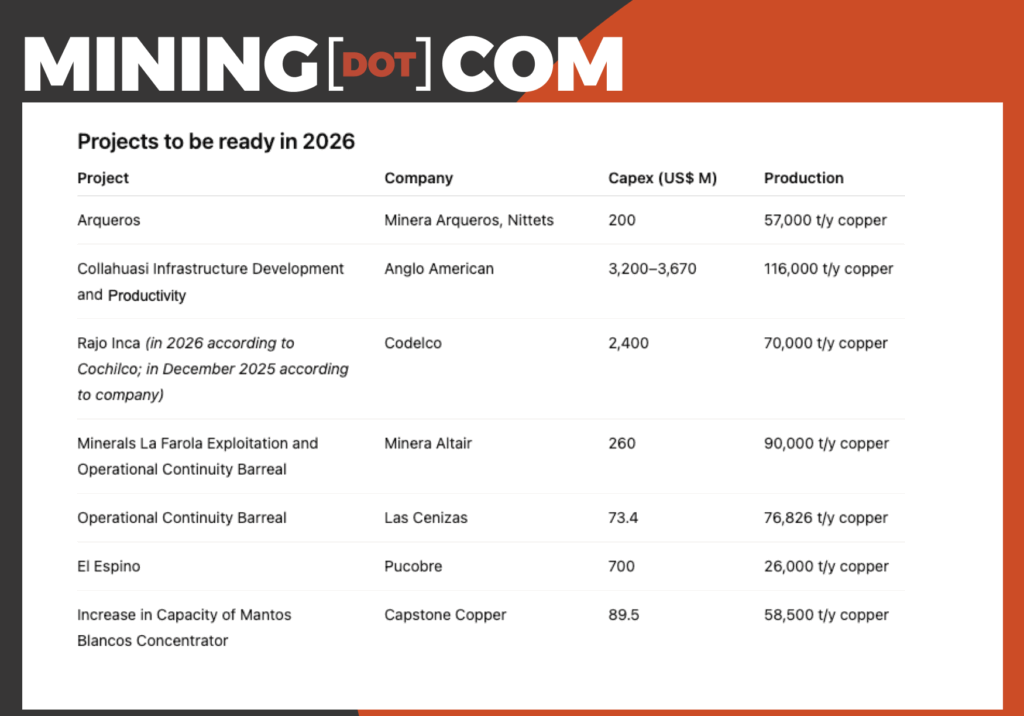

Chile stands to benefit as seven domestic projects aim to start operations next year, adding almost 500,000 tonnes of annual capacity backed by $7.1 billion in investment, according to official figures.

The list includes Anglo American/Glencore’s Collahuasi infrastructure and productivity upgrades, known as project C20+, Codelco’s Rajo Inca structural project, Capstone Copper’s Mantos Blancos and Andes Iron’s debated Dominga.

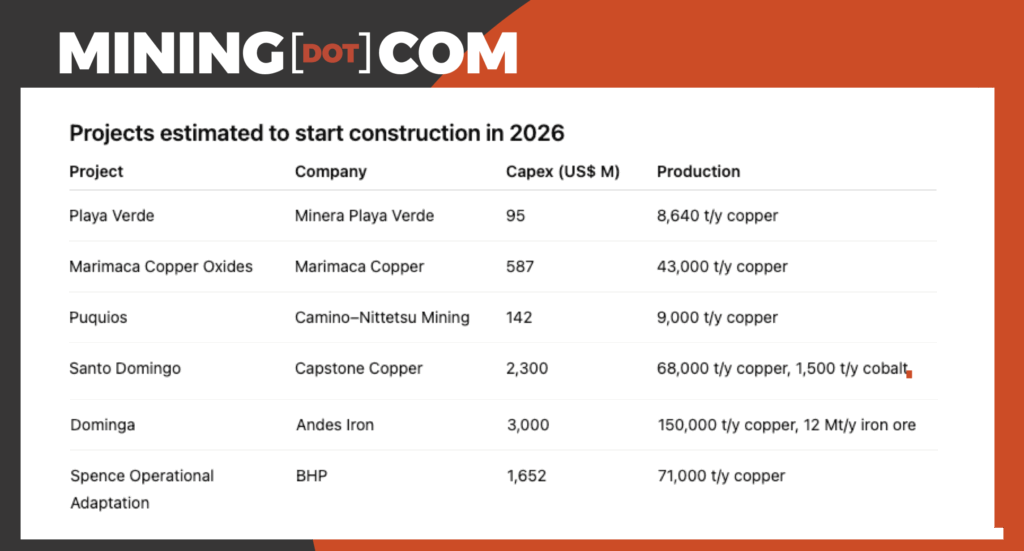

Another six developments plan to begin construction, representing $7.7 billion in spending tied to copper’s strategic role in energy and technology. Those include BHP’s Spence and Capstone’s Santo Domingo.

Juan Ignacio Guzmán, CEO of Chilean mining consultancy GEM, said that while several projects are scheduled to begin producing in 2026, they won’t achieve full ramp-up immediately. Based on estimates from the Chilean copper commission (Cochilco) Guzmán noted the pipeline could lift Chile’s output to about 5.6 million tonnes, or roughly an additional 100,000 tonnes of fine copper within a year.

The analyst said the International Copper Study Group sees a 2026 deficit of 150,000 tonnes, a gap that would widen if Chilean projects stall.

Source: Companies files, MINING.COM.

Source: Companies files, MINING.COM.

“The long-term reality is that building a new mine is difficult. Nearly everything the global economy wants to invest in is copper-intensive, including the energy transition and AI,” Benchmark Minerals copper analyst Albert Mackenzie said.

Guzmán said the main risk for Chile’s 2026 slate lies with community relations rather than market dynamics or the new government taking office in March 2026.

Source: Companies files, MINING.COM.

Source: Companies files, MINING.COM.

“The role of communities will continue to be relevant,” he said. While projects starting operations have already cleared key hurdles, he warned that those set to begin construction face ongoing approval processes that could end up in court.

The consultant also highlights that significant investment is essential for these projections to materialize. State-run Cochilco expects the country to attract $105 billion from this year through 2034. The agency notes the estimate includes expansions at consolidated operations such as BHP’s (ASX: BHP) Escondida, the world’s largest copper mine.

Katz factor

The recent victory of ultra-conservative former congressman José Antonio Kast, who is set to take office as Chile’s next president in March, is being viewed by markets as positive. Kast’s win represents a shift toward a more pro-investment, pro-development stance in Chile, mining investors said.

His administration is expected to streamline permitting and environmental approvals, reduce regulatory uncertainty and offer greater fiscal stability, lowering the risk of new tax or royalty changes mid-cycle.

......................................